5-Star Underwriters 2023

Jump to winners | Jump to methodology

Underwriting excellence

The 2023 IBC Brokers on Underwriters awards commend 45 outstanding Canadian insurance professionals persevering in a challenging field. They are all making profitable decisions, as well as delivering outstanding customer service to brokers and internal stakeholders.

“Being an underwriter is not an easy job,” says Sylvester Slowakiewicz, director of personal lines at Billyard Insurance Group. “Almost every interaction, be that a call, email or in-person conversation, involves processing a large amount of information and making conclusive decisions within very short timeframes.”

Hundreds of Canadian brokers participated in IBC’s survey, sharing their exclusive insight into what they want from underwriting partners. The chart below details what’s most important to them.

“We want to spend the time and help them understand the risks that are in front of them and help them make sure they get the right coverages”

Alexander Blair-Johns, Signal Underwriting

Alexander Blair-Johns, Signal Underwriting

Communication wins business

The top factor in determining if underwriters could earn more business from brokers is making communication a priority.

Morgan Roberts, director of Ontario for RH Insurance, says a top-performing underwriter “should be a person who is able to answer any question and go through coverages that a client may need”. She adds that “a great broker-underwriter relationship is key”.

This theme is emphasized by broker Laura Sauer of Alex Berthelot Insurance Brokers, who details what she wants. “Good or bad, I prefer to talk to my underwriter,” she says. “Less automated and more one-on-one calls.”

This is continued by Tino Buntic, associate broker at Sound Insurance Services, who comments that what matters to him is for the underwriter to “be available to answer phone calls”.

Some providers use online means to aid communication, but this tactic isn’t popular with IBC’s survey respondents.

Commercial broker Peter Krizanac of Acumen Insurance Group explains, “Insurers need to hire more staff to facilitate turnaround times and less focus on broker portals.”

Award winner Linden Kerr, managing director of Forward Insurance, a company that specializes in construction, offers an insight into why she is being honoured and has responded to what brokers want.

“As underwriters, we’re here to support our brokers, and remembering there’s a live human at the end of that submission or the referral or that email,” she says. “Providing great service to them means you roll up your sleeves, you stay late to get that quote out, you pick up the phone while you’re eating your lunch, you read that email before you get into the office.”

Being available to communicate and respond to brokers in a timely fashion isn’t easy, but for Kerr it’s a necessary part of the job.

“The most important thing to mention about being a really good underwriter for your brokers is the hard work that comes with it,” she says.

Summing up the frustration that brokers can encounter, Fred Legace of Kamloops Insurance Services details his peers’ expectations of quality service. “These days, the ability to pick up the phone to ask questions is primary. So many underwriters are hiding behind a corporate communication firewall.”

Winner Connie Givelas, senior property casualty underwriter with Special Risk Insurance Managers (SRIM), makes a point of being reachable and understanding what brokers want. She says, “I answer my phone, which is unusual these days. I return voicemails and, most importantly, I treat my brokers as I would want to be treated.”

“I answer my phone, which is unusual these days. I return voicemails and, most importantly, I treat my brokers as I would want to be treated”

Connie Givelas, Special Risk Insurance Managers

Connie Givelas, Special Risk Insurance Managers

Personal touch and turnaround

Brokers continually re-evaluate how they interact with their underwriting partners.

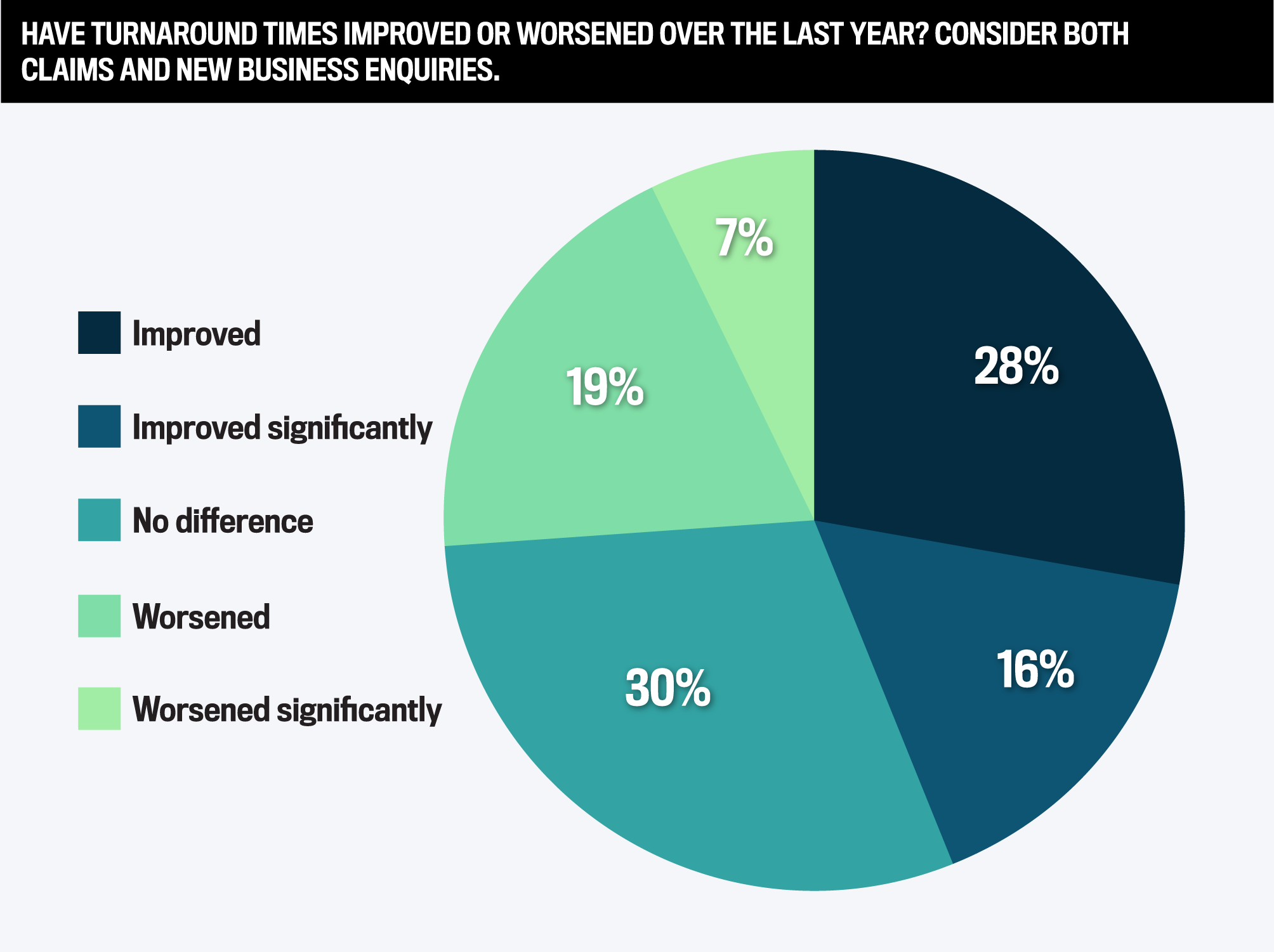

A major issue is turnaround time, with 74% of IBC’s respondents reporting that it has either improved or remained the same over the last 12 months.

Another key fulcrum is an accommodation and a willingness to deal with individual broker circumstances.

Krizanac explains what he expects in this area. “Someone who can be commercial but still maintain their integrity,” he says. “As brokers, we never want to feel like an underwriter is buying business or taking advantage of our trust.”

There is a requirement to deal with brokers in a personalized fashion.

Veralin Phillips-Michael, branch manager at First Foundation Insurance in Calgary, adds, “They should be willing to take each case individually and make a decision based on that case, not paint everybody with the same brush.”

This is another area that Kerr underlines her credentials as a 2023 winner. “I know my wordings but I never make assumptions… Our partners are really knowledgeable about what goes on in the marketplace and the products they’re selling. So, when they’re giving me feedback on my wordings, or the interpretation, that is something I need to really tune up and listen to in order to be able to move forward with it.”

Echoing this, Givelas says, “I love discussing new cases and possible scenarios with broker partners. I even guide them along the way with my underwriting knowledge so they’re aware of the risks involved with a particular class of business.”

She adds, “I look at all risks. I approach them based on what is needed and how I best can accommodate that risk and ways to think outside the box to get them terms now.”

Other survey respondents shed further light on the need for flexibility.

Beverley Fox of Westland Insurance Services comments on the expectations among her colleagues of their underwriter. “Someone who understands the insurance world and can think outside the box.”

Account manager at Nacora Insurance Brokers Robyn Caicedo further details that brokers value an “ability to negotiate and strategize when issues occur, and communication is open and honest.”

Another winner, Alexander Blair-Johns, the CEO of Signal Underwriting, specializing in healthcare, underscores the importance of educating and accommodating brokers. “We want to spend the time and help them understand the risks that are in front of them and help them make sure they get the right coverages.”

“As underwriters, we’re here to support our brokers, and remembering there’s a live human at the end of that submission or the referral or that email”

Linden Kerr, Forward Insurance

Linden Kerr, Forward Insurance

Constant innovation

IBC’s winners understand that staying ahead of the game is vital as if they stand still, brokers will find underwriters who are pushing forward.

To win more business, Blair-Johns plans to keep up service levels, assisting brokers with placements, and knowledge transfer. “The other thing that we’re doing, we’re bringing new products to the market,” he says. “We have three or four new products that will be coming out in the next six months.”

As Forward celebrates its first anniversary, Kerr says the company is being responsive, consistent, accessible, and competitive and is releasing 18 more products in the next year.

At SRIM, Givelas is going to focus on maintaining mutual trust. “It is not enough to be very responsive anymore. It is about being solution driven,” she says. What is clear is that remaining a top-performing underwriter is a challenging and continuous process.

This is encapsulated by Slowakiewicz, who adds, “Undoubtedly, it’s a demanding task, but if you approach brokers as your clients and the way you’d like to be treated as a client, you will quickly develop a reputation as the go-to industry expert and preferred business partner.”

Alexander Blair-Johns

CEO, Class Underwriter

SIGNAL Underwriting

Amanda Settee

Underwriting Specialist, Construction

Zurich Insurance Company

Brad Clisdell

P/C Midmarket Underwriter

Aviva Canada

Carly Philps

Senior Underwriter

Cansure

Catherine Wu

Senior Commercial Underwriter

Cansure

Christine Lepore

Senior Underwriter

Travelers Canada

Connie Givelas

Senior Property Casualty Underwriter

Special Risk Insurance Managers

David Park

Commercial Underwriter

PMU Specialty Underwriting Managers

Dawn Morris

Manager, Underwriting

Billyard Insurance Group

Denise Lasiuk

Cheif Technical Underwriter

Equitable Life of Canada

Erin Clingwall

Personal Lines Property

SGI Canada

Gabriel Morneau

Senior Vice President

CHES Special Risk

James Pond Jones

Vice President, Casualty and Environmental Liability

i3 Underwriting

Jean Marsden

PL Underwriter

Peace Hills General Insurance

Jean Mullin

Commercial Underwriter

GFH Underwriting

Jennifer Scott

Senior Field Underwriter

CHES Special Risk

Joanna Yee

Trading Underwriter

Royal and Sun Alliance

Jo-Anne Thayer

Senior Personal Lines Underwriter

Intact Insurance

Joyce Rajadurai

Senior Underwriter

CHES Special Risk

Katherine Benton

Underwriting Specialist

Great American Insurance

Kelly McGuiness

Team Lead Canada, Production Underwriting and Business Development (East)

Coalition

Laura Stanley

Senior Commercial Lines Underwriter

Portage Mutual

Leah Vineberg

Underwriter, Commercial Insurance

Burns & Wilcox

Linden Kerr

Managing Director

Forward Insurance

Louise Dion

Manager, Underwriting

Northbridge

Mark Morilla

Senior Portfolio Underwriter

Unica Insurance

Mark Paje

Senior Casualty Underwriter

Chutter Underwriting Services

Meagan Woensdregt

Managing Director

Lions Gate Underwriting

Megan Braun

Residential Underwriter II

Red River Mutual Insurance

Michelle Downes

Senior Commercial Auto Underwriter

Aviva Canada

Mike Wilkinson

Underwriting Manager

Starr Insurance and Reinsurance Limited

Morgan McBain

Underwriter II

Wawanesa

Nicole McLean

Underwriter I, Commercial Lines

Intact Insurance

Raquel Awad

Associate Underwriter

CNA Financial

Richard Karim

Senior Underwriter

ARAG Legal Solutions

Sarah Davies

Supervisor of Operations

GFH Underwriting

Serena Bosley

Underwriting Assistant (Pl)

Beacon Underwriting

Shelly Fedoruk

PL Underwriter

Peace Hills General Insurance

Shirley Standing

Underwriter

Beacon Underwriting

Stacy Goddard

Senior Underwriter

Agile Underwriting Solutions

Steffi Lehman

Team Lead & Personal Risk Services Senior Underwriter

Chubb Vancouver

Steven Hrab

Director, Construction

Burns & Wilcox Canada

Tara Schlosser

Commercial Lines Underwriter

Wawanesa

Yar Ziolkowski

Property & Casualty Specialist

Sovereign General Insurance

To uncover the best underwriters in the Canadian insurance industry, the Insurance Business team undertook a rigorous marketing and survey process, leveraging its connections to brokers across the country. Brokers were asked to nominate their underwriters and rate them on six key criteria: communication, new business turnaround times, knowledge of their own products, knowledge of their competitors’ products, being solution-oriented, and ability to discuss new cases. Underwriters that were rated 80% or greater were named 5-Star Underwriters for 2023.