5-Star Insurance Networks and Alliances in the USA

Jump to winners | Jump to methodology

Finding fellowship

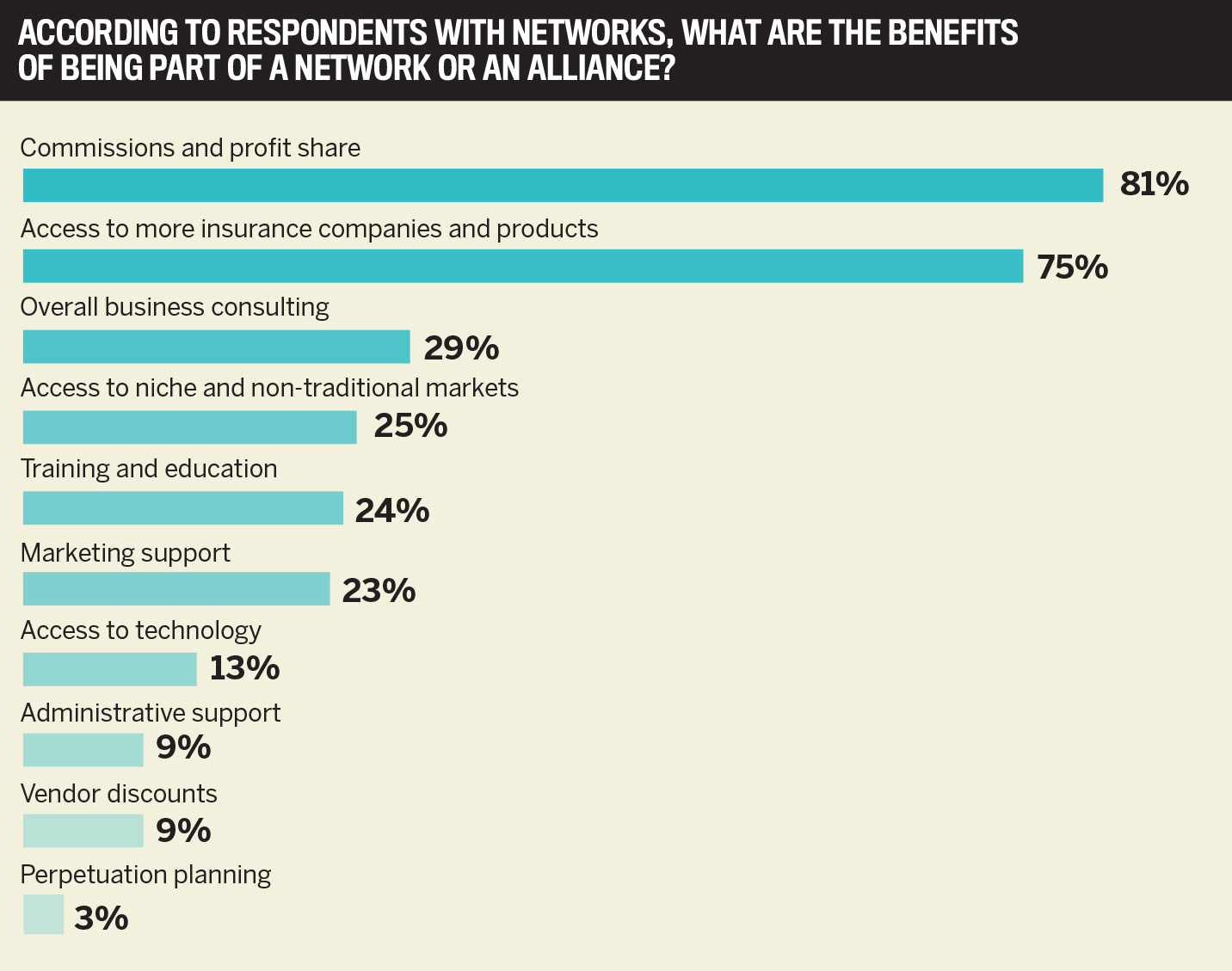

Agents can be supercharged by connecting to insurance networks. The top-performing networks harness a range of benefits such as greater access to products, the ability to tap into non-traditional markets, vendor discounts, and even marketing support.

However, finding the right network is key.

“I tell my agents, you’re part of my family”

John TieneStrategic Agency Partners

To that end, Insurance Business America’s 5-Star Networks and Alliances 2023 recognizes some of the best in the industry as ranked by agents across a range of criteria.

These groups are making a resurgence, according to John Tiene, managing director of Strategic Agency Partners.

“There was a time when agents worked together to take care of their community,” he says. “Sometime between the 1970s and 1990s, that got lost. But it’s back, insurance is about scale. The more scale, the more influence and opportunity exists.”

One for all

Strategic Agency Partners is one of this year’s 5-Star winners.

“There’s a demand within the agent community for what we provide,” explains Tiene. “We help them better manage their agencies. Help them utilize technology. Help with perpetuation – that’s just good business planning. If you get hit by a bus, what happens to your agency?”

By joining Strategic Agency Partners, agents can expect to:

increase contingency revenues into the double digits

acquire advice on deploying additional capital to improve operations

improve employee retention or attract more staff

leverage technology to improve efficiencies

act like business owners in a group setting

further empower women who account for 70 percent of agency employees

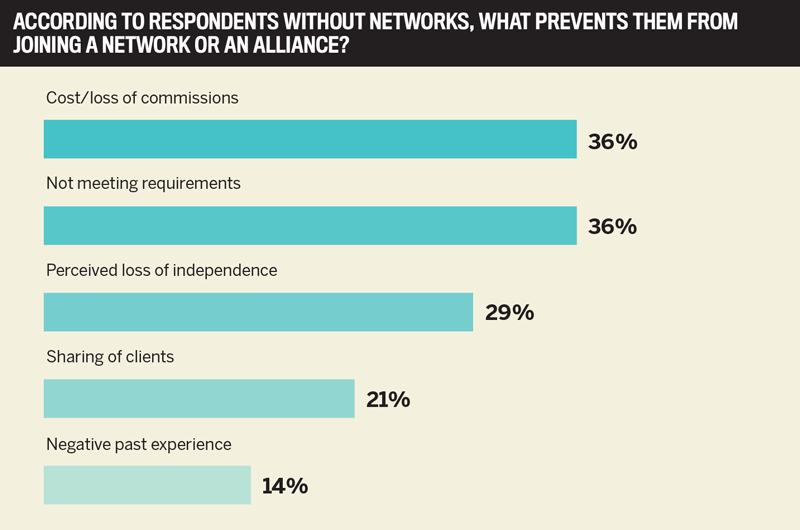

Some survey respondents had their reservations about joining a network. Reasons cited by some agents were that they may:

make members do things they don’t want to do

pry into members’ client files

withhold payment unless a commission goes to one central agency

However, Joe Craven, the CEO of 5-Star winner Fortified, explains why he feels this is an outdated perception.

“What they’re saying is the furthest from the truth,” he explains. “We don’t have any of the client information. We don’t take their commissions.”

Since forming in 2022, Fortified has been able to:

establish 61 agents in eight states

be present in over 170 locations and 1,800 employees

achieve close to $3 billion in written premium

“I think carriers prefer working with us because we’ve proven that it’s cheaper to do business with us than with standalone agencies”

Robert QaoudValley Insurance Agency Alliance

Craven also offers a real-time assessment of issues faced by agents across the US, which can be alleviated by joining networks like Fortified.

“The rising cost of repairs, the rising cost of materials, are all having an impact on rates of the insurance companies,” he says. “They can’t get enough rate quick enough to be able to turn a profit. This has been going on for nearly two years, and we’re going to still be in this for another two years.”

Uniting 54 independent agencies across the southeast US, Fortified offers the following advantages:

helps manage carriers on their behalf

encourages collaboration

leverages its history of profitability to maintain good standing with carriers

provides better profit sharing

negotiates better vendor agreements

“Independent agencies are the foundation of our industry,” explains Craven. “They’re small businesses that work hard to provide the best coverage possible for their clients, but unfortunately being a ‘small’ business can make it harder to develop partnerships with carriers. Fortified is a collection of independent agents with similar core values.”

Director of operations Robert Qaoud of fellow 5-Star winner Valley Insurance Agency Alliance (VIAA) also knows how transformative a network can be for agents.

“Some of the other networks out there can really ruin it for the good ones,” he says. “Plus, there’s a lot of myths out there. If we can get them to listen, we can show them the value and the reality of what we have to provide versus the perceived loss of independence.”

With VIAA,

89 percent of members make more with profit sharing and override the costs to be a member of network

165 members have over $600 million in-force premium

“Members can lean on each other’s expertise and that goes a long way for members that are coming in. We also do a really good job of managing the relationships with the carriers on their behalf”

Joe CravenFortified

Director of enterprise development Bill Kaatman adds, “There are some enhanced commissions we provide, and we negotiate at a local or a national level. We run our numbers and we are very keen to the fact that we have a majority of our members who we pay more than they pay us, and we’re extremely proud of that.”

The family of Pierce and Sue Powers formed VIAA in 2006 to help small agencies meet common challenges and they:

provide a more cost-effective carrier relationship than a standalone agency

have a special collaborative spirit resembling a “brotherhood”

offer access to markets, business consulting, and profit sharing

“We’re nothing without our members,” explains Qaoud. “We’re fortunate just to work with really good people. We have core values, and unless a prospect exudes those values, we don’t work with them. We really want to work with good family people and help them enhance their legacy.”

Network strength

Many of the major issues in the industry are a knock-on effect of the pandemic. However, that allows insurance networks to show their added value by assisting agents in a challenging economic climate.

“COVID happens,” says Tiene. “People aren’t driving. Regulators say you have to give customers’ money back. So, they forced carriers to either give credit or reduce rates. The commercial side was a bit easier. People were being laid off – we could do some stuff there.

“Meanwhile, supply chain issues are creating costs, so I can’t get the fender I need to put on my car. So, the rental car is going to be out a little longer. Then, because of the supply chain, the prices go up and then people start driving again, so frequency and severity go through the roof. Meanwhile, the regulators are still saying, ‘Well, it’s COVID.’

“You layer inflation on top of that and you layer climate impact on frequency and severity – and this is just the worst of everything.”

According to Tiene, networks help agents deal with these conditions by:

keeping them informed of the forces impacting them and their clients

collaborating with insurance company partners to gather information they may use with their clients, for example, why costs are going up

leveraging partnerships with insurance company partners to accommodate some of the impact from pricing pressures

And in relation to regional issues such as legislative changes in Florida and California, plus the challenging coastal regions, Tiene adds, “Being part of a network gives our members the flexibility and options to place those renewals with other markets because we offer much greater market access than your typical independent agent has access to.”

FirstChoice, a MarshBerry Company

Insurance Producer’s Network

ISU Insurance Agency Network

Valley Insurance Agency Alliance

Worldwide Broker Network

All-Stars

FirstChoice, a MarshBerry Company

Insurance Producer’s NetworkValley Insurance Agency Alliance

Valley Insurance Agency Alliance