5 Market Issues to Watch

2. Raising Expectations

Analysts have been raising their earnings forecasts faster than they are marking them down for previously unloved groups, from health care to utilities.

In fact, seven of 11 sectors in the S&P 500 are poised to see profit growth accelerate over the next year. Utilities, financials and health care are the lead sectors when ranked by 25th-percentile earnings revisions, with energy, materials and communication services at the bottom, BI data show.

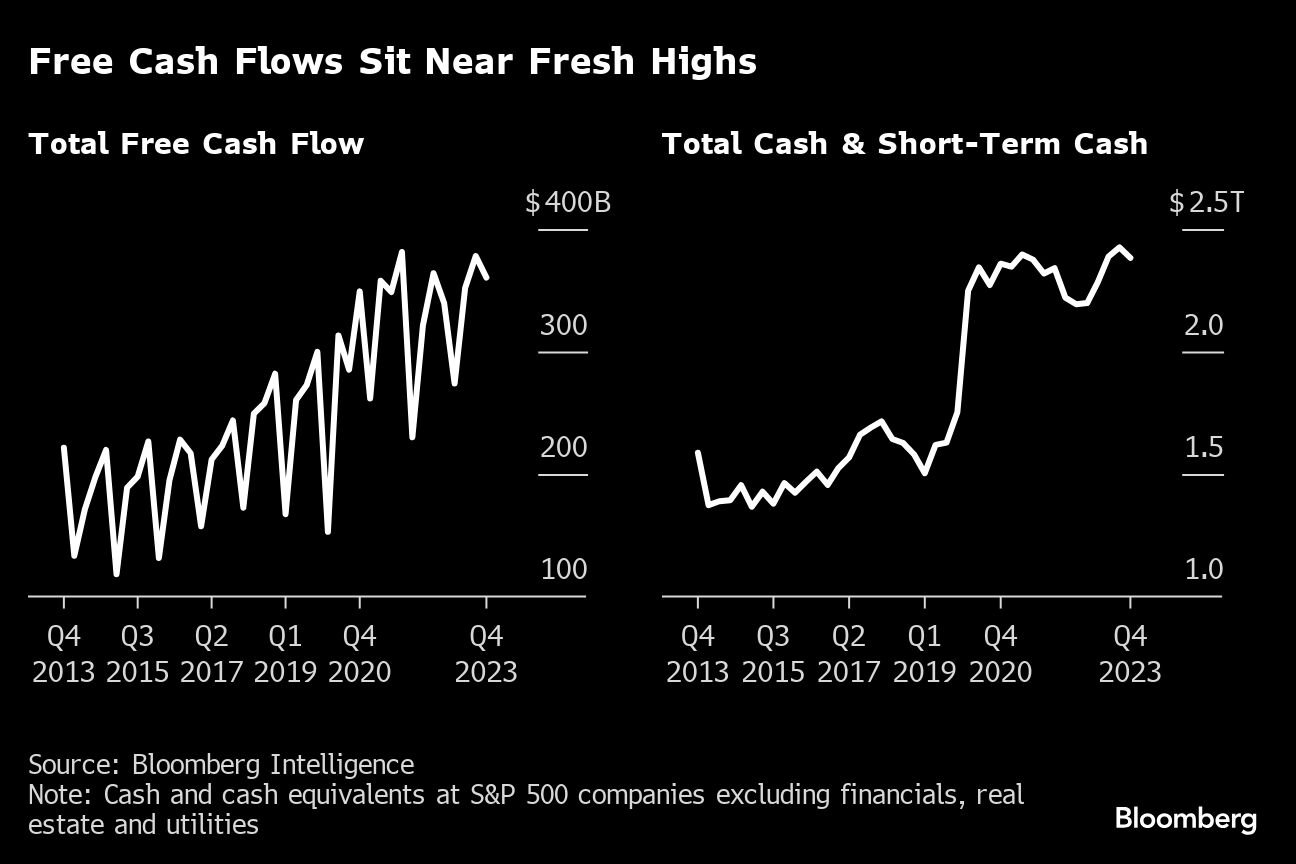

3. Cash Hordes

Corporate cash and free cash flow are at record high levels, setting the stage for a recovery in how the largest U.S. companies deploy their capital, whether through payouts to stockholders or investing in expanding their businesses.

Shareholder payouts rebounded in the fourth quarter for S&P 500 companies, and buybacks revived after four consecutive quarters of declines, BI data show.

An increase in capital expenditures will depend on a rebound outside the heavy-spending technology sector, BI’s Soong said.

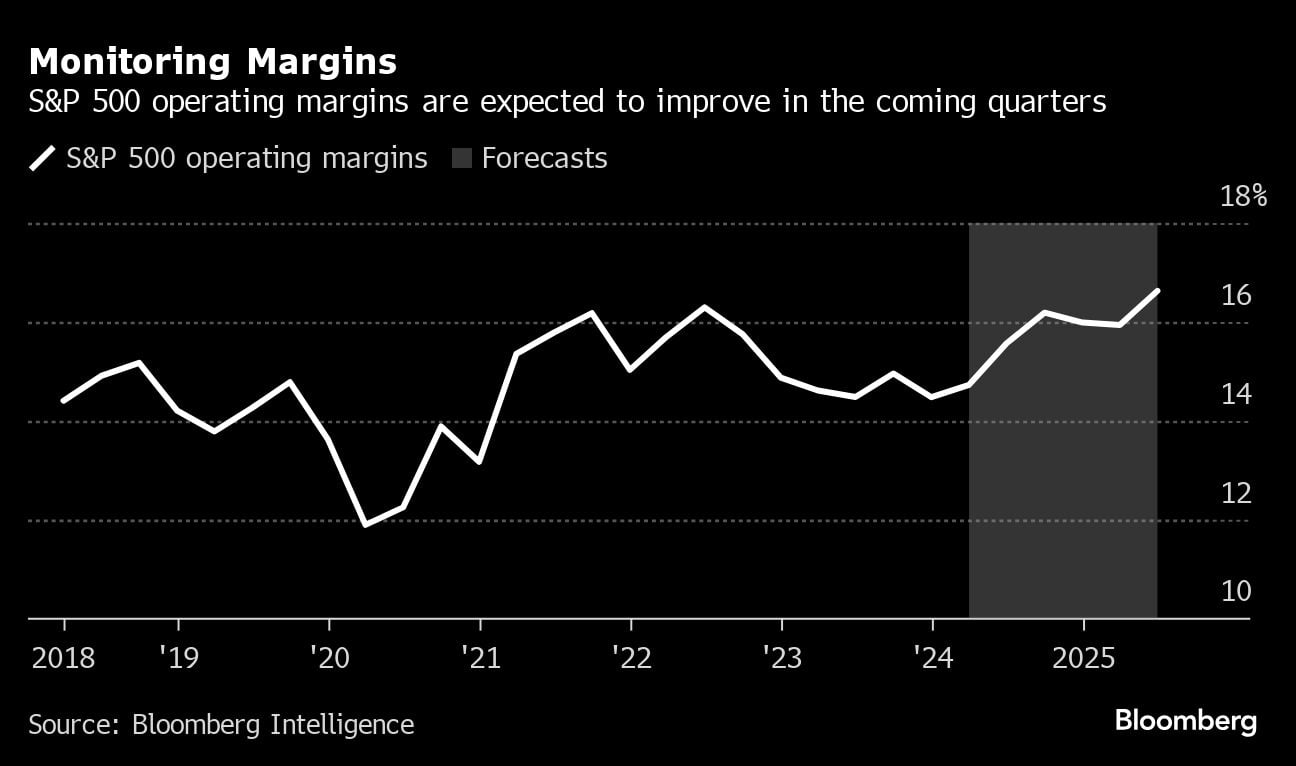

4. Margins Improving

Traders will be keeping a close eye on operating margins, a key gauge of profitability that historically offers a signal on where a company’s stock price is headed.

The gap between rising consumer and producer prices has narrowed significantly over the past year thanks to corporate cost-cutting that drove profits higher, as well as an unexpected artificial intelligence boom.

Analysts now see operating margins for the first quarter at 15%, with the worst of the pain in the rear-view mirror as forecasts improve in the coming quarters, data compiled by BI show.

5. Sector Picking

Traders aren’t expecting share prices to move in unison this earnings season. Differing inflation outlooks for S&P 500 sectors has left a gauge of expected one-month correlation in the index’s stocks hovering near its lowest since 2018, Bloomberg data show. A reading of 1 means securities will move in lockstep, it’s currently at 0.16.

This comes as three of the 11 groups — communication services, technology and utilities — are expected to post profit expansions of more than 20%, while energy, materials and health-care companies will likely see profits shrinking.

Contrary to popular belief, moderate inflation historically has been good for earnings broadly because it promotes growth, lending and borrowing, according to Dan Eye, chief investment officer at Fort Pitt Capital Group.

“Earnings are in nominal terms, so having a little inflation in the system isn’t a bad thing for corporate profits,” Eye said. “The stock market clearly sniffed that out in the first quarter, given the big rally.”

(Credit: Adobe Stock)