4 Things to Know About Auto Insurance Cards

Most people are aware that they are legally

required to carry their license, registration, and proof of insurance

while driving. But when it comes to auto insurance cards, many people have

questions, like why do I need to have an insurance card? What information is

stored on an insurance card? How often do I need to update my insurance card?

Can I carry my insurance card electronically?

We’ve got the answers to your questions here!

Continue reading below to learn about auto insurance cards and why they are

important.

Why Do

I Need to Have an Insurance Card?

Insurance cards, also known as insurance ID

cards, act as proof of insurance. When you register a vehicle in New York

State, the Department

of Motor Vehicles requires a copy of your insurance card as proof of

insurance coverage, as well as electronic confirmation from the insurer, in

order to complete the registration. When registering a vehicle, drivers must

provide the DMV with proof of insurance within 180 days of the

coverage’s effective date.

Additionally, the name on the insurance card

and registration must match.

New York State law requires motorists to have

Personal Injury Protection, Bodily Injury Liability, Property Damage Liability,

and Statutory Uninsured Motorist coverages to register a vehicle.

If your vehicle’s registration is suspended as

a result of lapsed insurance, you will need to renew your policy and provide a

new insurance card in order to have your vehicle registered again.

Furthermore, drivers are required to carry

proof of insurance while on the road in order to

present it to law enforcement in the event of an accident or traffic stop.

What

Information Is Stored on an Insurance Card?

Your insurance card contains different

identifying information pertaining to you, your vehicle, and your insurance policy, including:

●

Your name and address

●

Policy number

●

Coverage effective and expiration

dates

●

Your vehicle’s year, make, model,

and Vehicle Identification Number (VIN)

●

Your insurer or your agent’s name

and address

●

A 3-digit code identifying your

insurer

How

Often Do I Need to Update My Insurance Card?

Most insurance companies offer auto insurance in 6-month policies, with some

offering 12-month policies. Your insurer will send you two copies of your

insurance card upon the policy being issued. It’s a good idea to keep one copy

in your vehicle, and one copy on hand for instances in which you must provide

proof of insurance, like when registering a vehicle at the DMV.

When you pay your premium and renew your auto

insurance, you will receive two updated insurance cards in the mail. When you

receive new insurance cards, make sure you replace the old ones in your vehicle

so that if you need to present proof of insurance, you have the right copy

available.

Make sure you are aware of when your auto

insurance policy expires to ensure your insurance is up

to date and to avoid any lapses.

Can I

Carry My Insurance Card Electronically?

In 2015, New York State changed a regulation

in order to allow motorists to offer proof of insurance electronically. This

means you can store and carry your insurance card on your smartphone, which

enables you to ensure you have the most recent version available in a

convenient location.

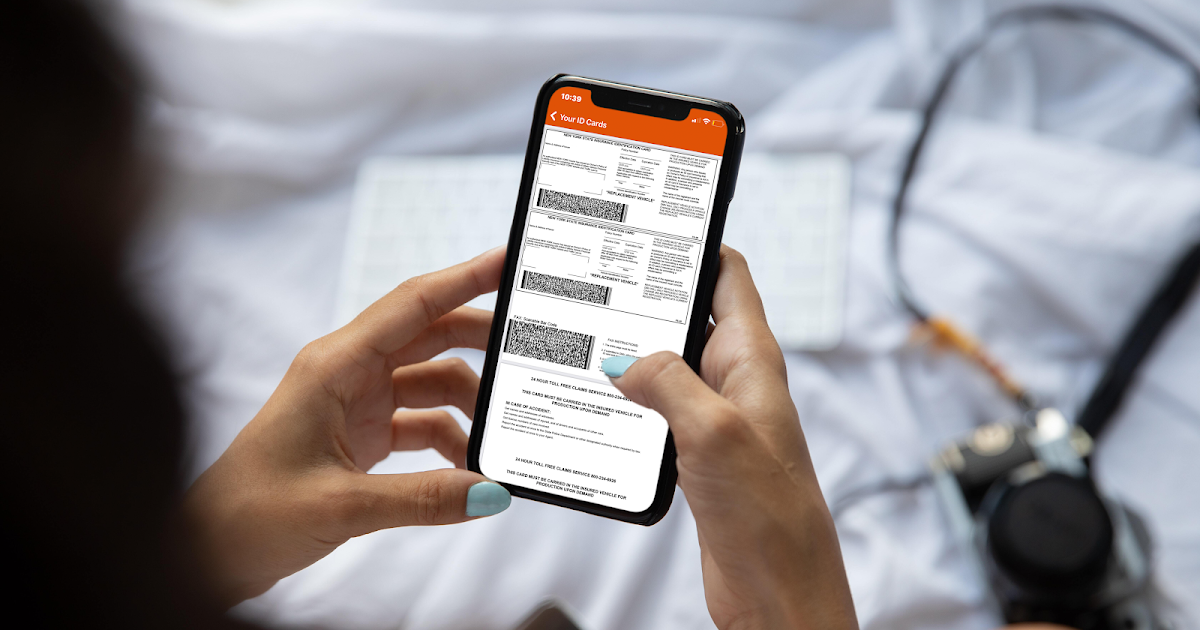

NYCM Insurance unveiled its newest mobile app

which allows policyholders to store their insurance ID cards all in one place

on their smartphone. The app enables policyholders to have a quick view of

their insurance ID cards, as well as PDF versions, which display your insurance

cards exactly as they appear in paper format.

By carrying your insurance card

electronically, you can be sure that you are always able to provide proof of

your coverage so long as you have your device and an insurance policy. You can

also worry less about your insurance card being lost or stolen and feel good

about going paperless and eco-friendly!

If you have a policy with NYCM Insurance,

don’t forget to download the mobile app where all of your insurance ID cards

are conveniently available in one place.

Click below to discuss your options for auto

insurance with an agent today!