3 Insurances that you have without even knowing: Part 3 of 3 [CareShield Life]

![3 Insurances that you have without even knowing: Part 3 of 3 [CareShield Life]](https://www.cheapsr22.us/wp-content/uploads/2023/02/1675233420_3-Insurances-that-you-have-without-even-knowing-Part-3.png)

For all of life’s inconveniences, pretty much nothing is worse than being in a state of limbo. Not being able to help yourself for the most basic of tasks, but not quite ready to roll over and die.

Correction.

Typing that out mid sentence, I did realize there is something that worse than being in a state of limbo.

Being in a state of limbo and not being able to afford it.

Now that is truly a keep-you-awake-all-night thought.

Not being able to care for yourself, needing assistance, not having an income, and having to drain my hard earned savings. No biggie.

This sets the stage for our final part of this series, where we explore the insurances that you have without evening know it: Careshield Life.

Read about Part 1: The Dependent’s Protection Scheme

Read about Part 2: MediShield Life

What is Careshield Life?

CareShield Life is a long-term care insurance scheme that provides basic financial support should Singaporeans become severely disabled, especially during old age, and need personal and medical care for a prolonged duration.

The term we use is Long Term Care: Careshield Life provides us with Long Term Care coverage.

Similar also to the Dependent’s Protection Scheme and MediShield Life, it is mandatory and administered by the CPF board.

What does it do for me?

When you are deemed to be severely disabled, the policy will pay out a sum of money each month for life (or for as long as you live AND are severely disabled).

There are 2 distant cousins of Careshield Life are: Eldershield 300 and Eldershield 400

Here’s a table of their benefits (each Singaporean resident is covered under either one of the 3 long term care schemes):

ElderShield 300

ElderShield 400

Careshield Life

Year of Launch

2002

2007

2020

Benefit each month if severely disabled

$300

$400

$600*

(Increases at a rate of 2% yearly)

Max Duration of Cover

5 Years

6 Years

Lifetime

What is Severe Disability?

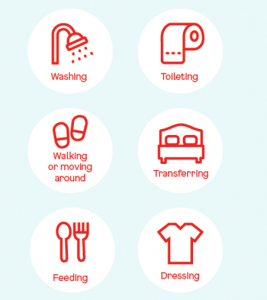

Glad you asked. There are 6 key activities that are deemed crucial for independent existence. Severe Disability is defined as the inability to perform any 3 (or more) of these 6 activities.

We call them the 6 Activities of Daily Living: ADL

What are the stats looking like?

In a word:

Good.

In two words:

Not good.

Sorry, we had to bring the Putin meme into this.

Anytime the government wants to step in to care for something, you know its grim. Cough GST, cough

According to the official Careshield website, 1 in 2 of all Singaporeans aged 65 could become severely disabled in their lifetime, and may need long term care.

And it gets worse.

Among those that are severely disabled, 50% of them stay disabled for 4 years or more.

30% of them stay disabled for 10 years or more.

Here’s how we frame the issue in a cold hard light:

Even if you are healthy, there is a 50% chance in your lifetime that you will be severely disabled and need long term care.

If that happens, there is a 30% chance that the severe disability remains for more than 10 years.

And here I am, not even able to look past my calendar for this week.

Truly brings things into perspective right?

What else can you do?

I can hear the collective groan at the back of this reality, and I can feel you slamming the table in utter disgust: Just tell me what to do next, goddamn it!

Two actionable steps here my friend, for your consideration:

Check if you are under Careshield life or Eldershield 300, 400 (via CPF)

Log into the CPF website here, and click on XX and YY. It should show you which scheme you are currently under, and if you are having any supplement coverage on that. (more about this on the next step)

Consider upgrading to CSL if you are still under Eldershield 300 or Eldershield 400.

Explore the idea of supplementing your Careshield Life coverage with various insurers

There are various insurers that have Careshield Life Supplement plans : Singlife, NTUC Income, Great Eastern, Tokio Marine

If you haven’t done so already, you can approach any of them to explore what options they provide in supplementing your existing Careshield Life or Eldershield schemes.

Round Up

Remember, its not all doom and gloom.

Insurance, by its nature, is meant to cover the worst case scenarios. And we are always reluctant to take action to confront our own mortality and fraility.

While you have a statistical chance of being unscathed and living till 105 in excellent health, the odds are often not in your favor.

In this series we covered the three types of policies that have been mandated for you to have, each with a key focus in mind:

The Dependent’s Protection Scheme – Death and Total Permanent Disability

Medishield Life – Hospitalization Costs

Careshield Life – Long Term Care Costs

Getting informed is just the first step.

Equally important, be a responsible grown up and take action to address your coverage shortfalls.

We’ve made it as easy as pie to understand your own financial situation, and explore the shortfall gaps in your protection portfolio.

What’s more, there is an unparalled advantage that we provide you: cash rebates for taking positive action via the Financial Advisory Representatives that we work with.

Sign up for your free account at ClearlySurely.com

Don’t say bojio!