3 Insurances that you have without even knowing: Part 1 of 3 [The Dependent’s Protection Scheme]

![3 Insurances that you have without even knowing: Part 1 of 3 [The Dependent’s Protection Scheme]](https://www.cheapsr22.us/wp-content/uploads/2023/01/3-Insurances-that-you-have-without-even-knowing-Part-1.webp-1024x683.webp)

There are many things in life we forget and take for granted.

Like electricity and opposable thumbs, they make our life infinitely easier but its not something that we are even consciously aware of at any given moment.

In this 3 part series, we explore the three Insurance plans that you most probably have, but have forgotten about.

We explain what each plan cover, what are the limits of each policy, and what options you have to enhance them.

Part 1: The Dependents Protection Scheme

Part 2: MediShield Life

Part 3: CareShield Life

Let’s use the marvel of electricity and your opposable thumbs to start reading.

What is the Dependents’ Protection Scheme?

It is an affordable term life insurance that provides insured members with some money to get through a period of time should you pass away, suffer from Terminal Illness, or Total Permanent disability.

This is administered through the CPF board, but the insurer is Great Eastern Life (Used to be NTUC Income till April 2021)

Yes, the same CPF that makes this person feel rich each time he sees it

Who is covered under this scheme?

Working Singaporeans who have contributed to CPF from the ages of 21 to 65. As long as you have made your first contribution, the Scheme would apply to you.

You do not have to actively enroll into it, since it is done automatically for you.

Read more about from the CPF Board and Great Eastern

How much does it cover?

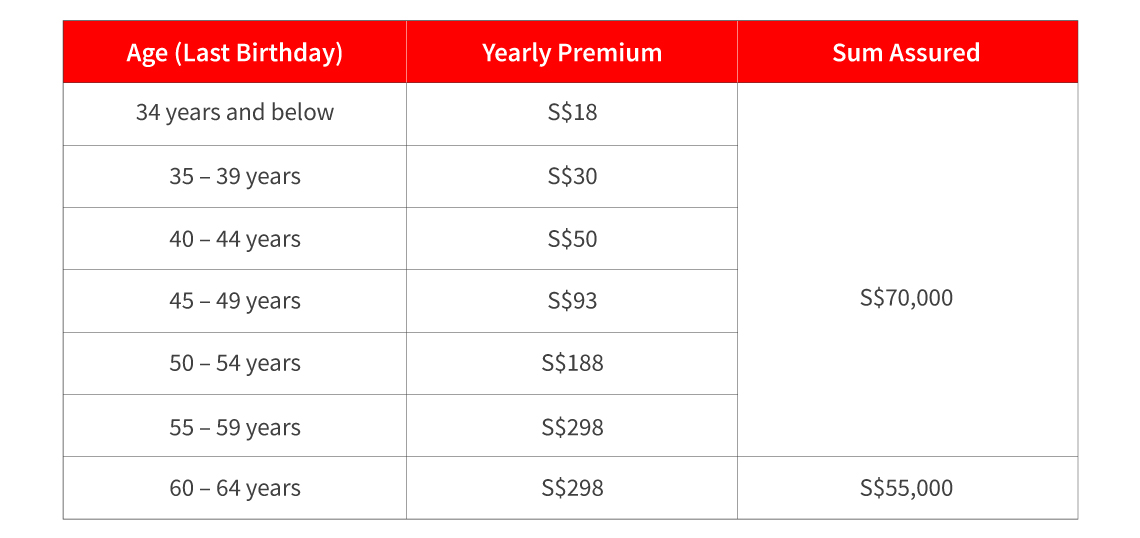

This depends on your age band. For most of us aged 21 till 59, the coverage is $70,000.

For folks between the ages of 60 to 64, the coverage is $55,000.

Again, this is done automatically, with no action required from you.

How do I pay for it?

It is deducted annually from your CPF OA. The premiums follow an age band, and increase progressively as you age.

What else do I need to do?

One thing that the Dependents Protection Scheme does not do for you is nominate the beneficiary(ies).

This is something that you have to do on your own accord, via the Great Eastern website here.

Death claims will be paid to the nominee(s) in one lumpsum according to the nomination.

If no nomination is made, the benefits will be paid to Proper Claimant(s) with reference to Section 61 of the Insurance Act (Chapter 142 of Singapore). A Proper Claimant can be the Executor of the deceased’s estate or family member, e.g. spouse, parent, child or sibling.

This means without a nomination, any Executor of your estate may claim the payout, which may not be in line with your wishes.

Is the Dependents Protection Scheme enough?

For the vast majority of us, the answer is no.

Especially when you have financial dependents (people that reply on your for financial support, like children or aged parents, or even siblings)

With inflation expected to hit 3.5 to 4.5% in 2023 by the Central Bank (MAS), a claim of 70,000 is not likely to last very long, and is only meant as a most basic amount of cover to tide your dependents over for a short period of time.

How can I enhance its cover?

To prevent financial hardship to your family due to an untimely passing, you can consider enhancing your death coverage either via Term or Whole Life Insurance plans.

There are plenty of options available via each insurer and you can compare the options available to you just by using our Financial Discovery Tool here.

In Part 2, we will be covering MediShield Life, the public hospitalization scheme.

Want to take action?

We can help.

Ready for a discovery experience that is out of this world?

Simply sign up for an account here and use our Financial Discovery Tool. We help you consolidate all your current insurance plans, plot out what are your gaps, and reward you for taking action.

When you purchase plans via our agent partners, you also get cash rebates which can range from $400 to even $1,000 or more.