2024 Semi-annual Market Outlook: Fixed income overview

Fiscal stimulus remains an upside risk to growth in both Canada and the U.S.. Government bonds remain attractive heading into the second half of the year. Corporate bond holders are not being compensated as much for taking on corporate credit risk, with spreads at near 20-year lows, although all-in yields look attractive.

2024 overview

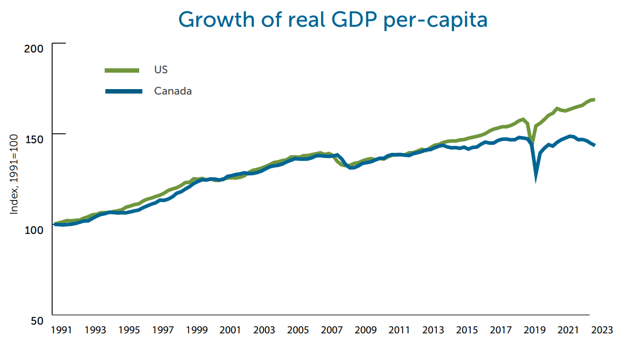

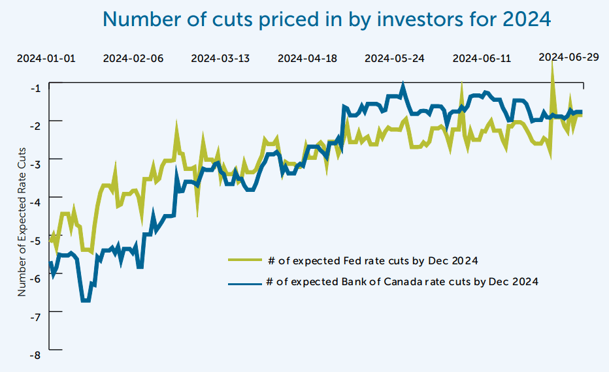

Canadian and U.S. interest rate policies are  closing out the first half of the year on divergent paths with the Bank of Canada easing, while the Federal Reserve remained on hold. Most measures of core inflation in Canada have been below 2% on both 3 and 6 month annualized bases,1 suggesting that the headline figure has some downward momentum ahead. The progress has been mixed in the U.S. where both CPI and PCE re-accelerated in the first quarter of 2024 but have since decelerated in the second quarter, with CPI coming in at or below 2% on a 3 month basis, and PCE remaining above, but closer to, the 2% target, on a 3 month basis, suggesting that U.S. inflation is beginning to show some downward momentum as well.2 We have also seen a divergence between the Canadian and U.S. economies in the first half of the year, with employment and retail sales figures in the former being weaker and debt delinquencies beginning to rise. Although the U.S. economy has remained resilient, we are starting to see excess savings being drawn down, credit delinquencies on the rise and a slowdown in employment. Further fiscal stimulus in the U.S. could continue to buoy growth.

closing out the first half of the year on divergent paths with the Bank of Canada easing, while the Federal Reserve remained on hold. Most measures of core inflation in Canada have been below 2% on both 3 and 6 month annualized bases,1 suggesting that the headline figure has some downward momentum ahead. The progress has been mixed in the U.S. where both CPI and PCE re-accelerated in the first quarter of 2024 but have since decelerated in the second quarter, with CPI coming in at or below 2% on a 3 month basis, and PCE remaining above, but closer to, the 2% target, on a 3 month basis, suggesting that U.S. inflation is beginning to show some downward momentum as well.2 We have also seen a divergence between the Canadian and U.S. economies in the first half of the year, with employment and retail sales figures in the former being weaker and debt delinquencies beginning to rise. Although the U.S. economy has remained resilient, we are starting to see excess savings being drawn down, credit delinquencies on the rise and a slowdown in employment. Further fiscal stimulus in the U.S. could continue to buoy growth.

Source: Statistics Canada, Federal Reserve Bank of St. Louis, as of December 31, 2023. Growth of GDP per capita shown in local currency.

Source: Statistics Canada, Federal Reserve Bank of St. Louis, as of December 31, 2023. Growth of GDP per capita shown in local currency.

Source: Bloomberg as of June 30, 2023

Source: Bloomberg as of June 30, 2023

Key themes we will continue to monitor

Macroeconomic

Key areas that we will continue to monitor in both Canada and the U.S. include employment and wages, the trajectory of inflation (where we expect headline inflation to remain above 2%), as well as inflation expectations and the strength of the consumer. We will continue to monitor the level of divergence between the Bank of Canada and the U.S. Federal Reserve, as there are limits as to how far policy can diverge between the two countries.

Government bond

Government bond

Government bonds remain attractive, especially at the front end of the curve in both Canada and the U.S. However, there is an opportunity cost of not “locking in” longer-term yields as we believe rates have peaked in Canada and the U.S. If the market consensus is correct and Canada announces further rate cuts and the U.S. follows in the second half of the year, we expect to see a re-steepening of yield curves, leading to less inverted curves.

Corporate Bonds

As economic data and earnings have remained resilient in the first half of the year, the market has increasingly priced in the likelihood of a “soft landing” and it now appears to have become consensus. However, we believe this remains uncertain.

With the exception of CCC-rated bonds, spreads across the spectrum have tightened year-to-date and are at near 20-year lows.3 This means that corporate bond holders aren’t being compensated to the same degree for taking on corporate credit risk as they have in the past. Despite this, all-in yields are near historical highs4 and provide attractive opportunities to invest in issuers where we have a high degree of certainty that default risk is relatively low.

Investment Grade

Given that spreads are at historical lows, we expect they are likely to widen. However, as corporate fundamentals remain strong and investment grade companies have abundant access to capital, we don’t expect the widening to be significant. Given the current spreads, we move into the second half of the year favoring A-rated and select BBB-rated bonds where there is relatively little credit risk.

High Yield

Although balance sheet fundamentals remain strong, we have seen some deterioration in high-yield bonds. In 2023, default rates increased roughly 2.5%5, and most market strategists expect them to increase by up to 2-4.5% more. We expect the overall spreads of companies rated CCC and below to widen in the second half of the year, leading us to prefer BB-rated bonds.

![]() Download the full Empire Life 2024 Semi-annual Market Outlook (PDF).

Download the full Empire Life 2024 Semi-annual Market Outlook (PDF).

1 Consumer Price Index, May 2024, Statistics Canada

2 Personal Income and Outlays, April 2024, Bureau of Economic Analysis, U.S. Department of Commerce, June 2024

3 Bloomberg, May 31, 2024

4 Bloomberg, May 31, 2024

5 “Default, Transition and Recovery: 2023 Annual Global Corporate Default and Rating Transition Study”, Standard & Poor’s, March 28, 2024

This document reflects the views of Empire Life as of the date published. The information in this document is for general information purposes only and is not to be construed as providing legal, tax, financial or professional advice. The Empire Life Insurance Company assumes no responsibility for any reliance on or misuse or omissions of the information contained in this document. Information contained in this report has been obtained from third party sources believed to be reliable, but accuracy cannot be guaranteed. Please seek professional advice before making any decisions.

Empire Life Investments Inc. is the Portfolio Manager of certain Empire Life segregated funds. Empire Life Investments Inc. is a wholly-owned subsidiary of The Empire Life Insurance Company.

Segregated fund contracts are issued by The Empire Life Insurance Company (“Empire Life”). A description of the key features of the individual variable insurance contract is contained in the Information Folder for the product being considered. Any amount that is allocated to a segregated fund is invested at the risk of the contract owner and may increase or decrease in value. Past performance is no guarantee of future performance.

® Registered Trademark of The Empire Life Insurance Company. All other trademarks are the property of their respective owners.

September 2024