2024 Predictions: How are carriers focusing on technology and innovation?

Patricia De Melo Moreira/Bloomberg

Insurers are focused on managing and mitigating risks, both for themselves and their policyholders, and in October 2023, Arizent, the publisher of Digital Insurance, reached out to professionals at insurance carriers, agencies and tech firms to ask where they would be focusing their time and resources in 2024. A total of 100 qualified leaders and staff at insurance carriers (40%); managing general underwriters, agencies and brokers (32%); and insurtech firms (27%) participated in the survey.

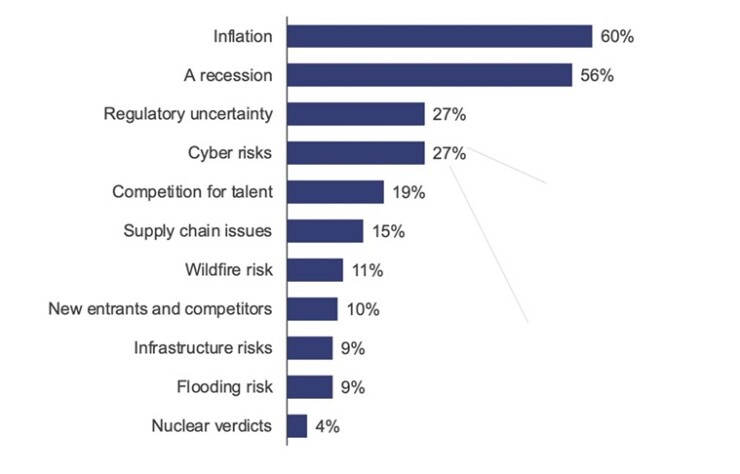

Technology is identifying many risk exposures before they become expensive losses for insurers; however, a number of outside forces are expected to affect business growth this year. The most significant macroeconomic factors are inflation, a leading threat to 60% of respondents, followed by a recession at 56%. Speaking to the issue of recession, 44% of respondents think one has already started or is very likely to occur in 2024, 47% put the chances at 50/50 and 9% think this is unlikely to happen. Compare this to the data from 2023, where 67% thought an economic recession was likely and 0% thought it was unlikely.

Regulatory uncertainty tied with cybersecurity (27%) is the third factor most likely to impact insurers in the coming year. Interestingly, employees at the staff (44%) and middle management level (44%) identify this as a threat compared to only 12% of senior management and 14% of C-suite executives. (Figure 1)

Figure 1: Inflation and recession are seen as the top threats to business growth in 2024.

Investing in technology and innovation

The increased adoption of technology requires that carriers invest in multiple areas. As companies have emerged from the pandemic, the amount they anticipate spending and where they will focus their resources has seen minimal change from 2023. According to our research, 65% of the firms expect to increase their tech spending in 2024, a 4% decrease from the previous survey, with 55% anticipating a moderate increase and only 10% budgeting for a significant increase.

A majority of the technology investments being made for 2024 are planned to be in areas that directly interface with customers, covering three of the top four priorities for digital transformation – customer service (21%), sales/quotes (19%) and claims (15%) – with product development at 17% being the only outlier (see Figure 2).

When asked which technologies are digital transformation priorities for their organization in 2024, respondents state that cloud technology and digital infrastructure (30%) as well as artificial intelligence (AI) and machine learning (30%) are the top two areas of focus. There is a divergence in opinion when it comes to AI as a priority since middle management (45%) and staff (44%) rate it a higher priority than C-level executives (18%) and senior management (16%). Further down the technology priority list are big data and analytics (25%) and telematics (10%).

Keeping an eye on AI

While carriers have been quicker to adopt or consider new technologies in recent years, some aspects of AI – specifically the latest version of generative AI – are giving them pause because of the inherent risks with their use. While they recognize the value of using AI technology, 73% of carriers and agencies believe that it is too risky to utilize for their firms at this point in time. And their concerns extend out to their customers who may be using AI as well, with 68% of carriers and agencies reporting that they find it too risky to insure customers who may be using AI at this time.

Interestingly, while carriers and agents both recognize there are risks associated with the use of AI, insurers are more likely to agree at 83% that AI is too risky for their organization as compared to agents at 60%. When it comes to insuring policyholders against these risks the disparity between insurers and agents lessens as 71% of carriers find the technology too risky to insure customers who utilize it all as compared to only 66% of agencies.

Despite the risk concerns, carriers see very definite benefits to adopting AI because it enables them to automate certain aspects of the insurance process such as underwriting, claims, sales and the ever important first notice of loss (72%). Since insurers collect and manage vast amounts of data, the use of AI allows them to synthesize large amounts of data quickly and efficiently (61%). This in turn will save insurers and clients a significant amount of time and money, say 57% of the respondents.

Patrick Sullivan, senior vice president of integrated analytics for Munich Re North America Life concurs. “The biggest benefit,” shares Sullivan, “is just speed. If they have someone in their office or there’s someone on the phone, they can walk them through an application in real time. Again, an instant decision…They don’t have to spend all of that administrative time going back and forth with the applicant and the underwriting department, and getting medical records, which frees them up to spend more time developing business and talking to people about what their needs actually are.”

As mentioned earlier, there are concerns that the increased use of AI will enable more fraudulent claims, however, 39% of our respondents believe that its utilization will actually improve the chances of identifying these fraudulent claims.

The full version of the report is available here.