2022 Federal Budget @ your fingertips

2022 FEDERAL BUDGET

@ your fingertips

There are proposals in the recent Federal Budget that are important to you, your family and your business. Here’s

our handy tip sheet to help you manage your finances.

![]()

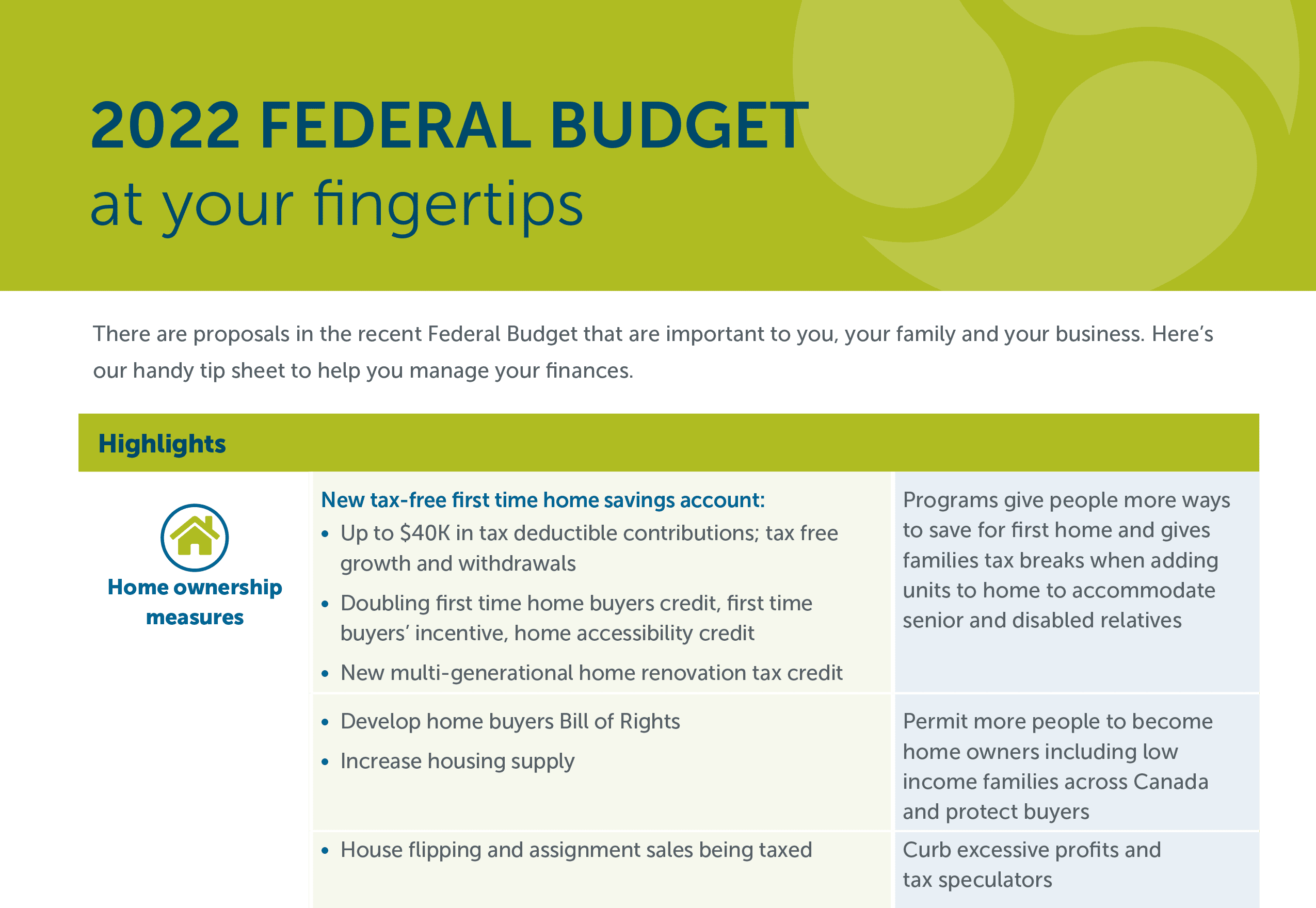

Highlights

![]()

Home ownership

measures

New tax-free first time home savings account:

Up to $40K in tax deductible contributions; tax free

growth and withdrawals

Doubling first time home buyers credit, first time

buyers’ incentive, home accessibility credit

New multi-generational home renovation tax credit

Programs give people more ways to save for first home and gives families tax breaks when adding units to home to accommodate senior and disabled relatives

Develop home buyers Bill of Rights

Increase housing supply

Healthcare

Increased health transfers to provinces and territories:

Dental care phase in targeting family households

earning < $70K; children, seniors and those living

with disability

Help with Pandemic expenses, deal with surgical backlogs Increasing support for lower income families starting with dental

Enhanced coverage for medical expenses and access to Medical Expense Credit

Expanding definition of “patient” and eligible expenses

So people have access to affordable prescription drugs

![]()

Small and medium

size business

Small business deduction:

Raise phase out ceiling from $15 Million of taxable

income to $50 Million.

Leaves companies with more after tax cash for reinvestment, profits, funds to pay for benefits, funding contingency plans

Employee Ownership Trust:

Looking at new dedicated trust under Income Tax Act

Aimed at enabling broad-based employee ownership of companies, supporting business succession, spreading wealth and promoting economic resilience

Corporation tax changes:

Substantive Canadian Controlled Private Corporations (CCPCs) are taxed on passive income as if they

remained CCPC

Level playing field for all private corporations regarding tax on passive income; leaves corporate owned life insurance strategies as sound alternatives to reducing tax on passive income

Intergenerational Wealth Transfer:

Government collaborating with key stakeholders to facilitate genuine family business transfers

Government making this a priority, eliminating uncertainties in transfers of family businesses

![]()

Going green

and clean

Emissions Reduction Plan:

Multiple investments and incentives in innovation and clean technology

Create incentives for consumers, businesses and investors to protect the environment

Taking care of our aging population and their pensions

Amending Pension Benefits Act and Pooled Registered Pension Plans Act:

Improve long term security and sustainability of federally

regulated pensions

Long Term Care:

$3 billion over five years, starting in 2022-23 with conditions to be worked out with provinces and territories

Response to long-standing criticism of funding for our aged

Mental Health initiatives Support:

$100 Million set aside over 3 years

Pandemic has emphasized and increased long-standing need for support

Talk to your advisor for more advice and information on managing your finances.

Source: A Plan to Grow Our Economy and Make Life More Affordable, Federal Budget 2022

This document is for information purposes only and is not meant to provide legal, financial, tax, or any other advice. Although care was taken in the preparation of this document, The Empire Life Insurance Company assumes no responsibility for any reliance on or misuse or omissions of the information contained in this document and cannot be held responsible for damages or losses arising from the use of this information. Please seek professional advice before making any decisions.

This blog reflects the views of the author as of the date stated. This information should not be considered a recommendation to buy or sell nor should it be relied upon as investment, tax or legal advice. Empire Life and its affiliates does not warrant or make any representations regarding the use or the results of the information contained herein in terms of its correctness, accuracy, timeliness, reliability, or otherwise, and does not accept any responsibility for any loss or damage that results from its use.

April 2022