144A property cat bond issuance breaks annual record at $12.6bn in 2023

Issuance of Rule 144A property catastrophe bonds has now officially set a new annual record for 2023, as the total issued surpassed $12.6 billion with the settlement of the latest transactions today.

2023 is on course to see almost all records broken in the catastrophe bond market and this is one of the most important.

Rule 144A property cat bonds are the bedrock of the cat bond market, making up the lion’s share of all deals issued each year and a category that has seen increasing focus from ceding companies, as an efficient source of reinsurance or retrocession.

Property catastrophe risk is the class of business that is most transferred to the capital markets in insurance-linked securities (ILS) form each year and makes up a considerable proportion of the overall ILS markets capital deployment each year.

144A property cat bonds are likely the fastest growing segment of the ILS market at the moment, thanks to strong investor demand driven by higher returns, as well as the increasing issuance from repeat and importantly new sponsors of cat bonds.

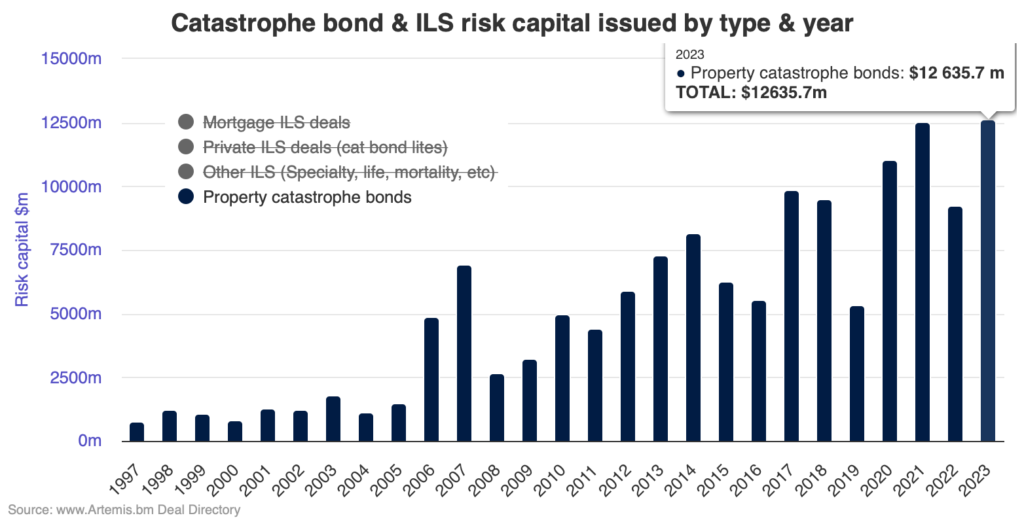

As of today, the settlement of the latest cat bond for the California Earthquake Authority (CEA), Ursa Re 2023-3, and the first ever cat bond from Crédit Agricole subsidiary Pacifica, Taranis Re DAC 2023, have lifted pure property cat bond issuance for 2023 so far to a record high of just over $12.6 billion.

The previous annual issuance record for pure 144A property cat bonds was set in 2021 at $12.5 billion.

You can analyse issuance by year and type of transaction using this chart (click here or on the image below for an interactive version where you can use the key to include, or exclude, types of deals):

By year-end, including all the new cat bonds in our Deal Directory as if they were to settle at the latest sizes we have for them, issuance of Rule 144A property catastrophe bonds would end the year at approximately $14.7 billion.

Total issuance, across these 144A property cat bonds, plus 144A cat bonds covering other lines of business such as cyber, life and specialty risks, as well as any private cat bonds we’ve included in our Deal Directory, currently sits at almost $13.8 billion.

This figure will also rise and set a new record, eclipsing the previous high of just slightly under $14 billion from 2021. In fact, it will reach and surpass that level within days, as the next deals in the cat bond pipeline complete and settle.

Once all currently marketed cat bonds are completed, the overall issuance total for the cat bond market, across the three categories we track, is currently forecast by Artemis to reach $15.9 billion by year-end.

With a number of new catastrophe bonds yet to be finalised and price this year, there is a very strong chance we see that total rise above $16 billion by the time December ends.

Stay tuned to Artemis as we move through the final weeks of the year for details of each cat bond as it prices and settles, as well as news on any new cat bonds that come to light, which could raise these forecasts for year-end totals even higher.

The Artemis Deal Directory lists all catastrophe bond and related transactions completed since the market’s first deal in the late 1990’s. The directory also lists the cat bonds waiting to settle, which are highlighted in green at the top of the list.

Analyse the catastrophe bond market using our charts and visualisations, which are kept up-to-date as every new transaction settles.

Download our free quarterly catastrophe bond market reports.

We track catastrophe bond and related ILS issuance data, the most prolific sponsors in the market, most active structuring and bookrunning banks and brokers, which risk modellers feature in cat bonds most frequently, plus much more.

Find all of our charts and data here, or via the Artemis Dashboard which provides a handy one-page view of cat bond market metrics.

All of these charts and visualisations are updated as soon as a new cat bond issuance is completed, or as older issuances mature.