10 ways to get cheap car insurance in Australia

Insurers calculate car insurance premiums based on a person’s overall risk level – and because each driver’s profile and situation vary, there isn’t a straightforward answer to this question. An insurance company that can offer you cheap car insurance, for instance, may be the most expensive option for another.

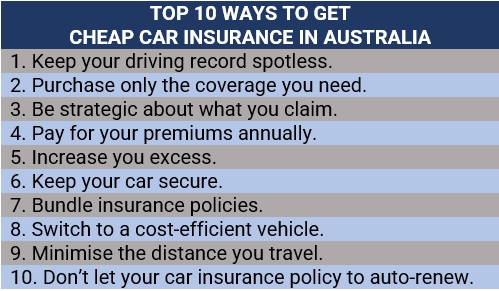

To help drivers find ways to access cheap car insurance in Australia, Insurance Business compiled several practical tips and advice from industry experts. Here are the top 10 premium-reduction strategies we gathered.

1. Keep your driving record spotless.

Maintaining a clean driving history is among the most effective ways for you to get affordable car insurance premiums. A good driving record shows insurers that your likelihood of getting into an accident is low, meaning it will cost them less to insure you.

Some experts also advise drivers – especially the young and inexperienced ones – to take safety driver courses to lower their risk level. These types of training are designed to inculcate situational awareness and teach proper response to emergency situations, which can make a driver appealing to insurers.

2. Purchase only the coverage you need.

With policyholders bombarded with coverage options, picking the right policies that match your needs can be challenging. There are times when you may be tempted to purchase optional extras, but always remember that these add-ons have a corresponding effect on the premiums you pay.

Before buying additional coverage, it is always wise to first assess your needs. Sometimes, a basic plan may provide sufficient coverage and will not cause a dent in your wallet. If you’re finding it difficult to work out which policies suit your needs, an experienced agent or broker can help steer you in the right direction.

3. Be strategic about what you claim.

Each claim you make will have a corresponding impact on your premiums come renewal time, so it pays to be smart about what to claim on. By being strategic in your claims, you can protect your risk rating and future rates. Most insurers also offer policyholders who have a spotless claims record with no-claims bonuses. This type of discount, which builds up every year, can slash up to 70% off your annual premiums after five consecutive years.

4. Pay for your premiums annually.

Another practical way to access cheap car insurance in Australia is to pay for your premiums in one lump sum instead of in monthly instalments. Some experts equate monthly payments to paying for a loan as you will surely be charged interest and finance arrangement fees.

There are some car insurance providers, however, that allow policyholders to pay monthly at no extra cost. If you’re one of those who budget their finances month-to-month, these insurers may be worth considering.

5. Increase your excess, but…

A higher excess means lower premiums but remember that this also increases the amount you need to pay out-of-pocket in case of an accident or theft. The key to this strategy is keeping the excess amount to a manageable level. However, if you’re confident about your driving skills and generally a safe driver, you may be able to afford more risk and take advantage of this strategy.

Ever wondered how an excess works? Check out our comprehensive guide on this insurance component – also called an insurance deductible – to learn more.

6. Keep your car secure.

Insurance companies like it when you take measures to improve your car’s security and typically reward you with discounts for doing so. Among the most effective means of keeping your car secure is by installing anti-theft devices. These include alarms, immobilisers, and steering wheel locks.

It can also help if your car is parked in a secure location, such as a closed garage, as vehicles left out on the street are more vulnerable to a careless driver, theft, or vandalism.

7. Bundle insurance policies.

Some insurers offer multi-policy discounts when you take out two different types of policies with them. For example, bundling your car insurance with your homeowners’ or renters’ insurance. You can also access multi-vehicle discounts if you insure more than one vehicle with your insurer, as long as these vehicles are registered to your household.

Before taking this route, however, be sure to check whether you are really getting better value or if splitting up your policies with different insurers leads to cheaper premiums.

8. Switch to a cost-efficient vehicle.

The choice of vehicle plays a key role in getting cheap car insurance in Australia. Picking a car that’s easy to repair and source parts for can help lower your premium costs. Some experts, however, warned against looking at just the car’s market value as some vehicles that cost less to purchase can be expensive to repair.

9. Minimise the distance you travel.

Some insurers will provide you with discounts if you drive less than 10,000 kilometres per year as driving less also reduces the likelihood of you getting into an accident. If possible, you can also use public transportation to drive down your mileage further.

Another option is to choose a pay-as-you-drive policy, which is cheaper and more suited for people who don’t drive often.

10. Do not let your car insurance policy auto-renew.

Reviewing coverage and shopping around for a better deal is something that experts recommend that you practice every year as this allows you to find a policy that you’re happier with. It can also help determine if you’re still getting value from your current car insurance.

Some experts suggest that you be on the look-out for special offers as there are insurance providers that will match or even beat their competitor’s rates to win clients.

Here’s a summary of our top tips on getting cheap insurance in Australia.

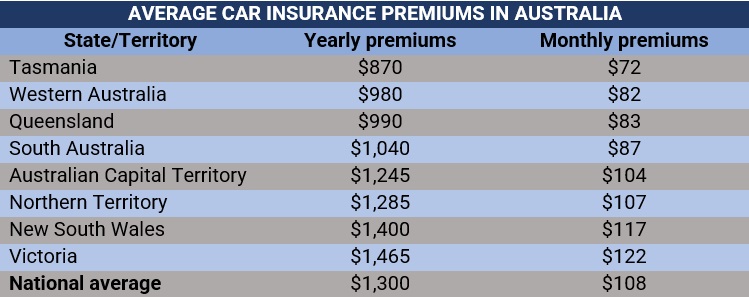

Based on several personal finance and insurers’ websites that Insurance Business checked out, the average cost of car insurance premiums in Australia is about $1,300 annually or $108 per month. Our research also found that:

Victoria has the highest yearly rates among all states and territories at about $1,465 or $122 monthly.

On the other end of the spectrum is Tasmania with respective annual and monthly premiums of $870 and $72.

Average annual and monthly regional car insurance premiums are $1,000 and $83, respectively.

For metro areas, yearly rates are about $1,235 or $103 monthly.

The table below shows a state-by-state breakdown of how much Australians pay in car insurance premiums, starting from the cheapest.

Your rates, however, can be significantly higher or lower depending on a range of factors that we will discuss in the section below.

Insurers consider a range of factors when calculating car insurance premiums, which makes it difficult to come up with a one-size-fits-all figure to cover every need. The following parameters will also determine if you are eligible for cheap car insurance in Australia.

Driver’s age: Young motorists are often perceived as riskier to insure and given higher premiums than older and more experienced drivers. If you’re a parent considering adding your teenage children to your policies, bear in mind that this can push up your premiums depending on your kid’s driving record.

Driver’s gender: Male motorists are statistically more likely to get involved in accidents and other risky driving practices, that’s why their car insurance rates are also higher compared to their female counterparts.

Driving record and claims history: Past accidents and claims increase your risk level, driving up your quotes as well. On the flipside, if you have a clean driving and claims history, insurers often reward you with discounts.

Coverage level: Basic coverage comes with the cheapest rates, but you can add optional extras – such as windscreen excess and roadside assistance – with a corresponding impact on premiums. Comprehensive policies, meanwhile, are more expensive, but already include many of these add-ons.

Choice of vehicle: A car’s market value is one of the biggest factors affecting premium prices. It is determined by looking at its age, make, model, condition, and kilometres travelled. Some insurers give an allowance for accessories under market value coverage, but this is subject to limits.

Premiums, however, work differently, depending on the type of policy. If you want to know how, you can check out our complete primer on insurance premiums.

Your age is among the biggest determinants of the amount of car insurance premiums you will pay. Typically, if you are between your 30s and 40s, you are charged lower rates compared to those in their 20s, who are considered high-risk drivers.

Those who have reached senior age, however, are also charged higher premiums, although they are not deemed risky drivers. According to the Office of the Road Safety (ORS), senior motorists bring a different set of risks that stem more from the condition of their health than their driving behaviour.

If you want to learn more about how car insurance works for this age group, you can check out our guide to car insurance for Australian seniors and pensioners.

Before you can find cheap car insurance in Australia, you must be aware of the coverage options available. There are four main types of general motor vehicle insurance in the country. These are:

1. Compulsory third-party (CTP) insurance

This is also known as green slip insurance in New South Wales or transport accident charge (TAC) in Victoria. It is the minimum coverage legally required in each state and territory. This covers your liability if other people are injured or killed in a vehicular accident. CTP insurance, however, does not cover your injuries and those sustained by your passengers, and damages to any vehicle or property. Compulsory third-party coverage is paid for when you renew your vehicle registration.

2. Comprehensive insurance

Comprehensive car insurance offers the broadest protection, that’s why it also has the highest premiums. This type of policy covers damages to your vehicle, as well as those of other people’s vehicles and property if you get into an accident, regardless of who is at fault.

Comprehensive coverage also provides protection against the following:

3. Third-party property damage (TPPD) insurance

TPPD insurance covers the cost to repair another person’s property, including their vehicle, due to an accident. This type of policy, however, does not pay out for damages sustained by your vehicle. If the accident involves an uninsured vehicle, some car insurers provide coverage only up to a certain amount.

4. Third party fire & theft (TPFT) insurance

TPFT coverage offers the same protection as TPPD insurance but extends coverage to include repair or replacement costs if your vehicle is stolen or damaged by fire, up to a specified limit.

One thing to take note of is that although cheap car insurance in Australia can often be tempting because of the initial savings you can make, it comes with its set of risks. By purchasing cheaper coverage, you may end up losing more, especially if the protection such policies offer is not enough to cover all your costs. To get the most out of your car insurance, you need to understand the choices available to you and the level of coverage you require.

Car insurance, however, works differently for imported vehicles. Find out how much it costs to insure one in our guide to insuring imported vehicles in Australia.

When looking for cheap car insurance, it’s important to get a good deal that’s also reliable. We recommend seeing our Best of Insurance page to find a company that’s vetted and trusted. Use the tactics above to get your insurance rates down and use one of our recommended insurance companies for reliability.

Do you think it is worth taking cheap car insurance in Australia? Are there better alternatives? Tell us your thoughts in the comments section below.