10 Top private health insurance companies in Australia

Top 10 private health insurance companies in Australia

1. Health Partners

Membership retention: 91%

Percentage of all complaints: 0.5%

Percentage of complaints investigated: 0.0%

Benefits as percentage of contribution: 88.5%

Management expenses as percentage of contribution income: 9.5%

Management expenses per average policy: $366

Market share: 0.7%

Adelaide-based Health Partners is South Australia’s largest open health insurer, providing healthcare coverage to more than 90,000 members, easily moving it to the top of our list of private health insurance companies in Australia. The not-for-profit health insurer also operates the state’s biggest private dental practice, along with several optical stores. Members can likewise access the organisation’s broad network of participating physiotherapists and pharmacies.

Health Partners provides Australia-wide hospital and extras cover, the benefits of which are detailed in the table below.

Byron Gregory serves as Health Partners’ chief executive officer, a role he has held since 2004.

2. HBF

Membership retention: 90%

Percentage of all complaints: 3.9%

Percentage of complaints investigated: 5.6%

Benefits as percentage of contribution: 89.7%

Management expenses as percentage of contribution income: 15%

Management expenses per average policy: $490

Market share: 7.3%

Founded in 1941, HBF is one of the largest not-for-profit health insurers in Australia, providing healthcare coverage to almost one million members across the country. It holds headquarters in Perth and has more than a dozen other branches in Western Australia.

HBF offers health insurance policies that cater to a range of demographics, including single parents and overseas visitors. Clients who purchase the insurer’s Basic Hospital Plus plan can access the following coverages for weekly premium payments of $14.06:

Dental surgery

Gynaecological services

Hernia and appendix treatments

Hospital psychiatric services

Joint reconstructions

Palliative care

Rehabilitation

Tonsils, adenoids, and grommets

Lachlan Henderson assumed the role of HBF’s CEO in February 2023. He was appointed to the role in October 2022. In 2021, HBF completed the acquisition of Brisbane-based CUA’s health insurance arm, increasing its overall market share, with almost a fifth of all members living outside Western Australia.

3. Westfund

Membership retention: 89%

Percentage of all complaints: 0.6%

Percentage of complaints investigated: 1.4%

Benefits as percentage of contribution: 88%

Management expenses as percentage of contribution income: 13.3%

Management expenses per average policy: $540

Market share: 0.9%

Although accounting for less than 1% of the country’s overall market, New South Wales-based Westfund ranks among the top private insurance companies in Australia when it comes to member retention. The not-for-profit health insurer provides hospital, dental, and eye care cover to more than 110,000 members across the country.

Westfund’s Basic Hospital Policy offers coverage for shared room accommodation and your choice of doctor at that hospital. The plan also includes unlimited emergency ambulance cover and $5,000 per member coverage for non-emergency ambulance trips.

In with Westfund’s mission of “building a new kind of healthcare for collective good,” the insurer returned over $5 million to eligible members as part of an extension of its COVID-19 Community Support Package in 2021. CEO Mark Genovese described the move as a way to “support our members through this very challenging time.”

4. HCF

Membership retention: 88%

Percentage of all complaints: 24.5%

Percentage of complaints investigated: 17.8%

Benefits as percentage of contribution: 89.6%

Management expenses as percentage of contribution income: 9.9%

Management expenses per average policy: $387

Market share: 11.9%

HCF was established in 1932 and has grown to become one of the largest combined health and life insurance providers in Australia. The not-for-profit insurer also offers travel and pet policies. The Sydney-headquartered private health insurance company serves about 1.8 million members.

HCF’s My Future 500 Basic Plus plan includes the following coverages for $24.25 per week.

Dental surgery

Ear, nose, and throat care

Hernia and appendix treatment

Joint reconstructions

Tonsils, adenoids, and grommets

Up to $750 cash back on extras treatment annually

Separate $180 cash back for optical services

At the height of the COVID-19 pandemic, HCF played an important role in helping its members cope with the uncertainties, providing coronavirus coverage at no extra cost, as well as online mental health programs. CEO Sheena Jack said these offerings were aimed at “[giving] our members the utmost peace of mind during this time.”

5. Bupa

Membership retention: 87%

Percentage of all complaints: 23.5%

Percentage of complaints investigated: 21.6%

Benefits as percentage of contribution: 84%

Management expenses as percentage of contribution income: 8.6%

Management expenses per average policy: $335

Market share: 24.8%

Bupa is an international healthcare services provider operating in more than 20 countries. In Australia, it has offices in Sydney and Melbourne, where it offers health and travel insurance. Apart from healthcare cover, Bupa members can access a range of services, including aged care and retirement, dental and optical care, and community wellbeing programs.

Bupa’s Bronze Plus Simple Hospital plan includes the following coverage at $21.19 per week:

Chemotherapy, immunotherapy, and radiotherapy for cancer

Ear, nose, and throat care

Gastrointestinal endoscopy

Gynaecology

Hernia and appendix treatment

Hospital psychiatric services

Joint reconstructions

Kidney and bladder treatment

Lung and chest treatment

Pain management

Palliative care

Rehabilitation

Tonsils, adenoids, and grommets

To support its clients during the pandemic, Bupa committed more than $50 million to support COVID-19-impacted customers, along with a hospital policy that covered coronavirus-related claims, regardless of the policy terms. Hisham El-Ansary, CEO of Bupa Asia-Pacific, announced the scheme while describing the pandemic as “a health situation like no other.” He took the helm as the region’s chief executive in 2018.

6. Medibank

Membership retention: 86%

Percentage of all complaints: 18.5%

Percentage of complaints investigated: 19.7%

Benefits as percentage of contribution: 83.6%

Management expenses as percentage of contribution income: 7.7%

Management expenses per average policy: $271

Market share: 27.3%

One of the top private health insurance companies in Australia – and the country’s largest – Medibank controls almost a third of the market. The insurer provides a range of healthcare services to its 3.9 million customers across the country. Among the standout features of its private health insurance plans are:

Accident cover boost, regardless of the level of coverage

24/7 phone access to a Medibank nurse

100% cash back on dental check-ups twice a year for extras cover

100% back on optical services for extras cover

Unfortunately, Medibank’s scale makes the company an attractive target for cybercriminals. The health insurer recently fell victim to a ransomware attack, which compromised the personal details of its customers. The situation led CEO David Koczkar to “unreservedly” apologise and pledge transparency.

7. nib

Membership retention: 81%

Percentage of all complaints: 9.1%

Percentage of complaints investigated: 9.4%

Benefits as percentage of contribution: 83.2%

Management expenses as percentage of contribution income: 10.3%

Management expenses per average policy: $353

Market share: 9.3%

An international health insurance provider, nib Group offers a range of healthcare and medical coverage to more than 1.5 million clients in Australia and New Zealand, and over 190,000 international students and workers in the country. The health insurer’s Basic Plus policy has the following inclusions for a weekly premium of $18.48.

Accidental injury benefit

Dental surgery

Emergency ambulance cover

Hernia and appendix treatment

Joint reconstructions

Gastrointestinal endoscopy

Gynaecology

Miscarriage and termination of pregnancy

Tonsils, adenoids, and grommets

In a recent interview with Insurance Business, CEO Mark Fitzgibbon revealed “another impressive” half-year results, which he said indicated “a symmetry returning to the businesses and profitability, after a period of COVID-led disruption.”

8. Australian Unity

Membership retention: 80%

Percentage of all complaints: 4.8%

Percentage of complaints investigated: 2.3%

Benefits as percentage of contribution: 79.2%

Management expenses as percentage of contribution income: 12.3%

Management expenses per average policy: $473

Market share: 2.5%

Founded in 1840, Australian Unity was the country’s first member-owned wellbeing company, offering health, wealth, and care services. It has since grown to become one of the top insurance companies in Australia. The Melbourne-headquartered health insurer’s Simple Hospital (Basic Plus) cover costs $51.49 per fortnight and has the following features:

Ambulance cover

Dental surgery

Hospital psychiatric services

Joint reconstructions

Rehabilitation

Palliative care

Tonsils, adenoids, and grommets

Hernia and appendix treatment

Rohan Mead is Australian Unity’s CEO and group managing director, a role he has held since 2004. Recently, the firm announced a $250-million property development project, which includes a new hospital, medical centre, and brownfield expansion in New South Wales, Victoria, and Queensland. These projects are expected to boost the value of the health insurer’s assets under management by almost a third.

9. GMHBA

Membership retention: 78%

Percentage of all complaints: 2%

Percentage of complaints investigated: 0.9%

Benefits as percentage of contribution: 86.3%

Management expenses as percentage of contribution income: 12.1%

Management expenses per average policy: $452

Market share: 2.1%

GMHBA is a not-for-profit health insurance provider based in Geelong and among Australia’s top regional private health insurers. It offers coverage to almost 370,000 Aussies through its GMHBA and Frank Health Insurance brands. Members can access the following features through GMHBA’s Bronze Plus Advantage Hospital cover at $22.55 per week:

Excess waived for same day stays

Back, neck, and spine treatment

Medically necessary plastic and reconstructive surgery

Dental surgery

David Greig leads GMHBA as its CEO. He was appointed to the role in 2021.

10. Latrobe

Membership retention: 78%

Percentage of all complaints: 0.8%

Percentage of complaints investigated: 0.9%

Benefits as percentage of contribution: 89.1%

Management expenses as percentage of contribution income: 13.8%

Management expenses per average policy: $560

Market share: 0.7%

Victoria-headquartered Latrobe Health Services is a not-for-profit private health insurer serving more than 81,000 members across Australia. Its Bronze Hospital plan covers the most common hospital treatments, including tonsils, adenoids and grommets, hernia and appendix, joint reconstructions, chemotherapy, and gastrointestinal endoscopies. Plan holders can also access the following features:

Cover for 18 of the 38 clinical categories defined under Australian law, including ear, nose and throat, gynaecology, chemo and radiotherapy, and miscarriage

Choice of $250, $500 or $750 excess

No excess for hospital admissions for children on a family membership

Unlimited emergency ambulance services

Ian Whitehead serves as Latrobe’s CEO, joining the company in November 2018.

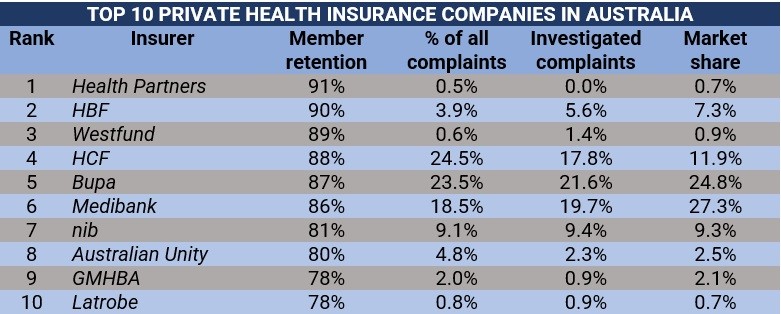

Methodology for the top private health insurance companies in Australia

Each year, the Private Health Insurance Ombudsman (PHIO) publishes a State of the Health Funds report to give both consumers and industry professionals comparative information on the service delivery and performance of all health insurers across the nation. Insurance Business ranks the top private health insurance companies in Australia based on the key metrics used in the annual study.

The table below sums up the top private health insurance companies in Australia.

What do these metrics mean?

PHIO compiles a range of performance indicators in its annual report to allow customers and health and insurance professionals to compare information about the top private health insurance companies in Australia. These are what the metrics above mean:

Member retention: Indicates the percentage of members that have remained with the insurer for at least two years. This reflects the comparative effectiveness of health insurers and their level of member satisfaction.

All complaints: Shows all complaints received by the Ombudsman about the insurer, including those investigated and finalised without needing investigation.

Complaints investigated: Represents the percentage of complaints that require a higher level of intervention from the Ombudsman, in relation to all complaints investigated.

Benefits as a percentage of contributions: Shows the percentage of total contributions received by the health insurer and returned to members in benefits.

Management expenses as a percentage of contribution income: Shows management expenses as a proportion of total insurer contributions. This is considered a key measure of insurer efficiency.

Management expenses per average policy: Provides a comparison of the relative amount each insurance company spends on administration costs.

According to the report, Australia’s private health insurance industry consists of:

24 open-membership private health insurance companies or those accessible to all Australians

11 restricted-membership private health insurers or those that have certain membership criteria

Our list comprises only the top 10 open-membership health insurers in the country based on market share and ranked by member retention.

How does private health insurance work in Australia?

Private health insurance is a type of policy designed to pay out for medical expenses that are not covered under Australia’s public healthcare system and Medicare. It can also cover the cost of your treatment in a private hospital or if you choose to be treated as a private patient in a public hospital. Private health insurance plans must only be purchased from registered health insurance providers.

Australians can access two main types of public health insurance:

Hospital cover: Pays out the cost of treatment in a public or private hospital.

Extras cover: Covers the costs of medical services not included under Medicare. This plan is also referred to as general treatment cover.

Meanwhile, ambulance cover, which includes emergency transport and medical care, can also be bought in most states and territories. The exceptions are Queensland and Tasmania, where the governments provide automatic coverage for permanent residents.

How much does private health insurance cost in Australia?

Based on our research, average rates for Gold cover are about $160 a month for a single policy. Monthly premiums for Basic, Silver, and Bronze policies, meanwhile are estimated to be $75, $80, and $115, respectively. To come up with these estimates, Insurance Business checked out the websites of the top private health insurance companies in Australia and several price comparison websites.

Premium prices of a private health insurance policy are dictated by a range of factors. These include:

Your age

Your income

Where you live

The level of cover

How many people the policy covers

Hospital cover comes in four different tiers – namely Gold, Silver, Bronze, and Basic – with each covering a mandated list of treatments. Because Gold policies cover all 38 types of treatments outlined by the government, they also have the highest premiums.

Each insurer calculates premiums differently. Find out how insurance companies determine this amount by checking out our comprehensive insurance premiums guide.

What are the advantages of taking out private health insurance in Australia?

Purchasing private health insurance policies offers four main benefits, according to the Department of Health. These are:

Expanded health cover and options: Private health insurance gives you the option to get treatment in a private hospital where waiting times for non-urgent procedures are much shorter. Your treatments can also be performed by your preferred doctor or specialist.

Tax incentives: You can avoid paying the Medicare Levy Surcharge (MLS), which is imposed on Aussies without private hospital cover and earn a certain level of income. The government charges this type of tax to encourage people to get private health insurance to reduce the pressure on the public health system.

Premium rebates: You can also receive an “income-tested” rebate from the government to help cover the cost of your health insurance premiums.

Avoid paying LHC loading: If you have taken out private hospital cover before turning 31 starting on 1 July 2000 – also known as your “lifetime health cover base day” – and have maintained coverage since, you can avoid paying an extra amount called “lifetime health cover loading.” If you didn’t, you may pay higher premiums for private hospital cover for the next 10 years.

If you want to know how private health insurance works in different countries, our global private health insurance primer can serve as a useful guide.

Where can you find the best private health insurance in Australia?

An experienced insurance agent or broker can help you find the right private health insurance that matches your healthcare and medical needs. Our Best in Insurance for Australia section can guide you in your search for reliable and trustworthy insurance professionals across the country.

Have you experienced working with the top private health insurance companies in Australia? How was it? Share your story in the comments section below.