10 Best insurance companies to work for right now in the USA

There isn’t a clear-cut top choice among the firms below as to which one offers the best work environment. All insurers in the list implement strong measures to keep workers engaged and offer competitive employee benefits. The rankings are, instead, arranged based on workforce size starting with the largest. Here are the best insurance companies to work for in the US based on our research.

1. Liberty Mutual

Workforce size: 45,000+

Head office location: Boston, MA

Liberty Mutual Holdings Company Inc. is the fourth-largest property and casualty insurer in the US and sixth globally in terms of written premiums. Its portfolio of insurance products includes:

Personal and commercial auto insurance

Homeowners’ insurance

Commercial property insurance

Workers’ compensation

General liability insurance

Multiple-peril commercial insurance

Specialty lines

Surety

Liberty Mutual unveiled its multi-year diversity, equity, and inclusion (DE&I) plan for employees in 2019. This serves as the company’s blueprint for increasing the representation of women and people of color at all levels of its businesses across the US.

When the COVID-19 pandemic struck a year later, an annual survey revealed that an astounding 92% of the mutual insurer’s overall workforce reported being “extremely satisfied” with the company as a place to work, rising from 85% in the previous year. This earned Liberty Mutual among the “Best Workplaces in Financial Services & Insurance” and “Best Workplaces for Parents” by Great Places to Work.

It was also in 2020 that Liberty Mutual launched its first-ever Global Employee Experience function designed to take a more “holistic, inclusive, and data-driven approach” to understanding what matters the most to its workers and collaborating with them to create exceptional experiences.

Liberty Mutual has also been named a Best Employer for Diversity and Best Employer for New Graduates by Forbes for providing ample opportunities for career growth for all employees. It has likewise been consistently included in several annual “Best Insurance Companies to Work For” awards and has scored a perfect 100 on the corporate equality index – a benchmarking survey that measures corporate policies and practices related to LGBTQ+ workplace equality – for five consecutive years.

2. Progressive Insurance

Workforce size: 45,000+

Head office location: Mayfield Village, OH

The Progressive Group of Insurance Companies ranks third among the US’ largest auto insurers, underwriting more than 13 million policies annually. It is also the top motorcycle and specialty RV insurer in the nation and writes commercial auto policies and several personal lines risks, including homeowners’ insurance.

Progressive places great importance on allowing employees to express their true selves and bring their strengths to work, making it among the best insurance companies to work for. The insurer also holds all employees accountable for sticking to its five core values – excellence, integrity, golden rule, objectives, and profit.

Progressive offers excellent benefits, including access to financial wellbeing programs, which provide the following:

401(k) retirement plans

Tuition assistance

Fair base pay

Annual bonus program

Company benefits also include:

Health, vision, and dental care

Health savings accounts

Mental health support

Access to fitness centers

Maternity support

Progressive placed 51st in Fortune’s 100 Best Companies to Work For and 65th in the 100 Best Large Workplaces for Millennials in 2022.

Competitive pay 💵

Culture 🤝

Community involvement 🌳

Diversity, Equity and Inclusion 💙

We could go on but take a look for yourself. See why Progressive is a great place to start or grow your #career. #JobSearch #PGRStrong

— Progressive (@progressive) April 28, 2022

3. USAA

Workforce size: 32,000+

Head office location: San Antonio, TX

USAA is the leading provider of insurance and other financial services to members of the US military, veterans, and their families, consistently ranking at the top of several customer satisfaction surveys.

But apart from providing excellent customer experience, USAA is one of the best insurance companies to work for in the country, giving employees and their families a range of benefits, including:

Medical and dental insurance coverage

Retirement savings plans

Paid time off

Rewards and recognition programs

Access to fitness centers and personal trainers

College admission assistance

Ongoing training programs

USAA ranked 87th in the 2021 edition of Fortune’s 100 Best Companies to Work For, the last time it was included.

4. Nationwide

Workforce size: 26,000+

Head office location: Columbus, OH

A Fortune 100 firm, Nationwide Mutual Insurance Company offers a full suite of insurance products to clients across the US, including:

Car insurance

Commercial insurance

Homeowners’ insurance

Life insurance

Motorcycle insurance

Pet insurance

Nationwide’s commitment to DE&I is reflected in how the insurance giant operates its business. It requires partners to show a “commitment to creating opportunities that promote supplier diversity.”

In addition, thousands of Nationwide employees participate in resource groups and unit councils each year, with the goal of fostering inclusion and improving business outcomes. The company also hosts events to celebrate the heritage of its employees to educate workers about diverse experiences and find ways to become diversity and inclusion allies.

The Nationwide Foundation, the insurer’s charity arm, is spearheading an initiative that allows associates to give a “matching gift” from the foundation to select non-profits focusing on economic empowerment and social equity. Nationwide leads all insurers in the latest Fortune 100 Best Companies to Work For, holding the 21st spot.

https://www.youtube.com/watch?v=0KWZhINpo-8

5. Farmers Insurance

Workforce size: 21,000

Head office location: Woodland Hills, CA

One of the country’s biggest providers of car, home, and small business insurance is also among the best insurance companies to work for, placing 89th in Fortune 100’s latest rankings.

Farmers Insurance Group prioritizes taking care of its employees and has implemented various strategies to provide support for its workers. One of these initiatives is the Farmers Family Fund, which allows the insurer to immediately respond when employees encounter financial hardship. Since its inception in 2012, the scheme has provided over $2.5 million in grants to employees in need.

Farmers Insurance also shows its commitment to inclusion and diversity by sponsoring different employee groups, including:

Farmers Pride

Women’s Inclusion Network

Veterans & Advocates

Farmers Asian Alliance

Somos Farmers

Black Professionals Alliance

Disability Inclusion Group

Farmers Future

FarmersFit

Parent Connect

Farmers Insurance also got a perfect score on the latest Corporate Equality Index from the Human Rights Campaign Foundation.

6. Mutual of Omaha

Workforce size: 6,000+

Head office location: Omaha, NE

Mutual of Omaha is a Fortune 500 mutual insurer offering a range of life and health policies. These include:

Life insurance

Group health insurance

Long-term care insurance

Medicare supplement

Annuities

The mutual insurer has various ongoing D&I initiatives, including:

Diversity & Inclusion Action Group (DIAG): Consists of Mutual of Omaha leaders who provide focus and direction for the insurer’s DE&I programs.

Advocacy and Advisory Council: Made up of associates from the company’s different units who are tasked to recommend opportunities for implementing DE&I strategies.

Mutually Connected: A compulsory culture-shaping workshop exploring concepts and values that support DE&I.

Mutually Inclusive: The mutual insurer’s flagship program is designed to reinforce concepts that “bridge connections across differences,” including anti-racism, allyship, and identity.

7. Allianz Life

Workforce size: 2,200+

Head office location: Minneapolis, MN

Allianz Life Insurance Company of North America has been a constant fixture of Fortune’s list for the past decade, placing number 77 in the latest edition. The company is a subsidiary of the global insurance giant Allianz SE and offers a range of retirement products, including individual life insurance plans and annuities.

Allianz Life’s LinkedIn profile states that it provides employees with a “creative, collaborative working environment with ongoing career development opportunities.” The specialist life insurer also offers a competitive compensation and benefits package, which includes:

Tuition reimbursement

Employee stock purchase plans

Retirement savings plan

https://www.youtube.com/watch?v=8b_PpBjyEdM

8. American Fidelity Assurance

Workforce size: 2,000+

Head office location: Oklahoma City, OK

American Fidelity Assurance Company secured the 53rd spot on the Fortune 100 Best Companies to Work For in 2021, thanks to its efforts to support employees at the height of the pandemic. Most recently, it was named among the top workplaces for IT by several industry experts.

American Fidelity provides supplemental benefits to its more than one million policyholders, consisting mostly of employers in the public, automotive, healthcare, and education sectors. Among the products and services the company offers are:

Supplemental insurance

Stop-loss insurance for self-funded plans

Affordable Care Act (ACA) consulting

Patient protection

Online benefits enrollment software

Reimbursement accounts and administration

Section 125 Plan administration

9. Lemonade

Workforce size: 1,100+

Head office location: New York, NY

Lemonade is the only insurtech firm on our list of the best insurance companies to work for. Apart from being among the drivers of digital transformation in the industry, the tech startup is a public benefit company and a Certified B Corporation.

Lemonade operates an annual giveback program, where it donates unused premiums to various charitable organizations chosen by its members. Since 2017, the insurtech firm has given back about $6.2 million to various non-profits across the country. Most recently, it has donated $1.9 million worth of unused premiums to different charities, including:

Charity: Water: Received $134,909 to support water projects in Mali

Direct Relief: Received $133,955 to provide emergency medical backpacks to Ukrainian refugees

350.Org: Received $118,443 for “climate justice” initiatives

Lemonade’s giveback program was recognized as one of the “World Changing Ideas” by Fast Company. The firm has also been included in the list of Best-Led Companies and Best Workplace in America.

The insurtech company uses behavioral economics and AI to offer insurance policies that are 100% digital, meaning every step – from providing quotes and underwriting to claims processing and approval – is done through its mobile app. Lemonade also charges a flat fee and boasts a “superfast” claims payment process. It once famously granted a claim in three seconds by using chatbots.

10. PURE Insurance

Workforce size: 800+

Head office location: White Plains, NY

PURE Insurance is a policyholder-owned insurance company committed to assisting individuals and families by offering a range of personal coverages, including:

Auto insurance

Home insurance

Cyber and fraud insurance

Jewelry insurance

Art and collectible insurance

PURE, which stands for Privilege Underwriters Reciprocal Exchange, caters to high-net-worth people who need assistance in protecting their assets. The insurer offers a transparent view of its processes, allowing policyholders to know exactly where their money is going and how their accounts are being managed.

Among PURE Insurance’s recent accolades are being included in the list of Best Workplaces in Financial Services and Insurance, Best High Net Worth Insurance Company, and Best Insurance Underwriter.

Meet Safiya Reid.

Safiya works in our Roswell office & leads our audacious efforts towards greater diversity, inclusion and equity at PURE.

👂 to her interview on @LivingCorp_Pod where she shares her career & more: https://t.co/a3uruhtrrK#diversityandinclusion #equity pic.twitter.com/vpApSbIVN0

— PUREinsurance (@PUREinsurance) March 12, 2021

Working for an insurance company can be both an exciting and rewarding experience as it gives you an opportunity to make a positive impact on other people’s lives. By serving as an expert resource person, you can help consumers make informed decisions about which types of policies provide them with the best financial protection.

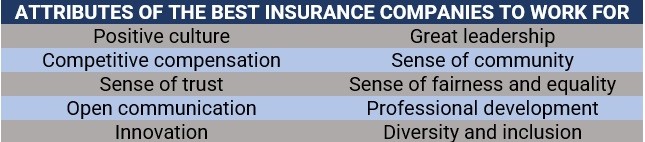

However, whether your tenure in an insurance company will be gratifying or upsetting depends on an assortment of factors, many of which are beyond your control, so it is best to pay attention to these during your job search. Here are some attributes that the best insurance companies to work for have in common:

Positive culture: A company culture that shares your values and ethics can keep you engaged and productive.

Great leadership: Employees look up to confident, effective, and fair leaders. They also help the company succeed.

Sense of community: The best insurance companies to work for form a community around their employees, where everyone’s goals are supported.

Sense of trust: Managers in healthy workplaces trust their team members to work hard and make good decisions. Employees, meanwhile, trust their leaders to guide and support them.

Sense of fairness and equality: Great companies provide a work environment where workers feel that they receive fair compensation and equal opportunities as their colleagues. These are also where workers are less likely to experience bias, favoritism, and politics.

Open communication: This allows companies to build trust and avoid misunderstandings.

Offers professional development: The best insurance companies to work for invest in its employees to help them grow professionally.

Transparency: Firms that are transparent about how they operate can earn their workers’ trust and commitment.

Innovation: Innovative insurance companies are those that are constantly evolving by creating new products and strategies. They also encourage employees to share creative ideas, make suggestions, and take calculated risks.

Diversity: Great companies embrace all employees coming from diverse beliefs and backgrounds.

Competitive compensation: An insurance company that cares for its workers gives them salaries that allow them to live comfortably and benefits that provide them with a financial safety net during unexpected situations. If you’re wondering which jobs in the industry offer the most compensation, you can check out our latest ranking of the highest-paying insurance careers.

Here’s a summary of the characteristics that the best insurance companies to work for share.

The best insurance companies to work for in the US make each workday both challenging and rewarding. Engaged employees, a positive work environment, and good compensation are just some of the signs you should be looking for if you’re searching for one.

These are the types of insurers you’ll find on our Best in Insurance America page. Here, you can find insurance companies that are nominated by their peers and vetted by our panel of experts as respectable market leaders. If you’re looking for a company that shares your values and provides the opportunity for professional growth, this is a good place to start your job search.

What do you think of the best insurance companies to work for on our list? Are there any insurers that you think we missed? Share your thoughts in the comments section below.