⚠ NEW YORK COVID-19 #BUSINESSINTERRUPTION CASE UPDATE ⚠

The “score” in New York on COVID-19 #businessinterruption coverage lawsuits, where “direct physical loss” or “direct physical damage” was at issue, now stands at 23-0 for insurers (18 federal, 5 state).

Manhattan-based policyholder in the business of office project management and furniture installation, sued its commercial property insurer for business income and civil authority coverage for losses allegedly stemming from its March 2020 forced closure during COVID-19. The policy’s business interruption coverages required “direct physical loss of or damage to property” and the policy included a “Microbe Exclusion” that included viruses.

In GRANTING the insurer’s motion to dismiss the complaint, with prejudice, the court ruled:

Critically, Plaintiff’s argument also fails to consider the extensive case law that has developed in New York on this exact issue over the past year, which provides that loss of use caused by the COVID-19 pandemic is not physical damage. Unfortunately, Plaintiff is only one of numerous businesses that suffered immense income loss after shutting its doors during the pandemic. Many of those other businesses have brought materially identical actions in New York seeking business impact coverage from their insurance providers. New York courts have consistently maintained that “direct physical loss of or damage” language requires physical damage to invoke coverage, and that loss of use due to the pandemic does not constitute physical damage when the covered property was physically unharmed by the virus. * * *As in the many analogous cases that have been brought in New York courts over the past year, the Court concludes here that the plain meaning of “direct physical loss or damage” unambiguously requires physical damage to the covered property to invoke coverage and that loss of usage does not rise to the level of physical damage. Plaintiff has failed to allege such loss or damage occurred, given that Plaintiff’s office remained physically intact and unharmed throughout its closure, other than having its doors closed to the public. Accordingly, Plaintiff is not entitled to coverage under the Business Property Coverage terms of the Policy. * * *The language of the Policy is unambiguous and bars Plaintiff from coverage. The Business Property Coverage terms of the Policy cover direct physical damage or loss, and the Civil Authority Coverage terms of the Policy cover losses when civil authorities prohibit entrance onto the covered property due to direct physical damage to neighboring properties. Plaintiff has failed to allege that either of those occurred, and instead only alleges loss of use and limited access to the covered property due to the threat of COVID-19. Furthermore, Plaintiff is not entitled to coverage because the Policy’s Microbe Exclusion explicitly excludes coverage for damages caused by “any virus,” which includes the COVID-19 virus.

Plaintiffs, an office equipment supplier and a dental practice, sued their commercial property insurers for business interruption coverage for losses allegedly stemming from their March 2020 forced closure during COVID-19. The policies’ business interruption coverages required “direct physical loss of or damage to property”, but did not contain a virus exclusion.

In GRANTING the insurers’ motion for judgment on the pleadings (post-answer motion to dismiss), the court ruled:

Plaintiffs’ policies provide coverage for business interruptions caused by “direct physical loss or damage” to their insured premises or due to orders of a civil authority issued in response to direct physical loss or damage” to nearby property that restricted Plaintiffs’ access to their premises. Plaintiffs argue that they suffered covered losses because the presence of the coronavirus at or near the insured premises constitutes “direct physical loss of or physical damage.”

To make this argument, Plaintiffs point to the existence of the so-called “Virus Exclusion” and the “Virus Limitation”: standard fmm endorsements developed by the ISO that exclude or limit an insured’s otherwise available coverage when the conditions of the endorsement are met. * * * Plaintiffs argue that this omission constitutes an “express acknowledgement by [Defendants] that a virus is capable of causing ‘direct physical loss of or damage to’ property.” (Doc. 78 at 18.) from this assertion, Plaintiffs jump to the conclusion that the presence of the coronavirus constitutes direct physical loss or damage.

However, Plaintiffs’ reliance on the Virus Exclusion and Virus Limitation is misplaced. Regardless of whether a virus could cause direct physical loss of or damage to property, Plaintiffs do not plausibly allege that the coronavirus caused direct physical loss or damage to their premises or property in the vicinity of their premises. The Virus Exclusion and Virus Limitation operate by limiting or excluding coverage that would otherwise be available under an insured’s policy; that is, they limit rather than expand coverage. Consequently, the endorsement becomes relevant only if an insured experiences an otherwise “covered loss.” In that case, the Virus Exclusion or the Virus Limitation would limit the insured’s recovery for the otherwise covered loss. In Plaintiffs’ case, however, the omission of the Virus Exclusion and the Virus Limitation from Plaintiffs’ policies is irrelevant because Plaintiffs have not plausibly alleged that they suffered “direct physical loss or damage” to their property.

Many courts applying New York law, including this one, have already concluded that business closures due to the presence of the coronavirus or due to New York State executive orders do not constitute “direct physical loss of or damage to” property. See Kim-Chee LLC v. Phil. Indem. Ins. Co., No. 1:20-cv-1136, 2021 WL 1600831, at *5 (W.D.N.Y. April 23, 2021); id. at *3 ( citing cases applying New York law). Relying on longstanding New York precedent, these courts have ruled that the phrase “direct physical loss or damage” is unambiguous and requires physical alteration of property. Kim-Chee, 2021 WL 1600831, at *4 (applying Roundabout Theatre Co., 751 N.Y.S.2d at 8).

The presence of the coronavirus does not physically alter property in a permanent manner. In this respect, the virus is different from other physical or chemical contaminants that have been found to cause “direct physical loss or damage” to property. Id. at *5 (citing gasoline seepage, lead contamination, exposed asbestos, pervasive odor, and chemical or bacterial contamination as examples of”[c]ontamination of a structure that seriously impairs or destroys its function,” thereby “qualify[ing] as direct physical loss”). Instead, the coronavirus poses a temporary health hazard to the occupants of a building, whose threat to human health dissipates with the passage of time. Many courts, including this one, have determined that merely temporary contamination does not qualify as “direct physical loss or damage.” Id. (citing dust from road construction, mold or bacteria that could be eliminated by cleaning, and the controlled presence of asbestos as examples of such “short-lived contamination). * * *

In this case, the alleged presence of the coronavirus has not caused a permanent change to Plaintiffs’ properties or decreased the value and function of those properties. Instead, New York State executive orders issued in response to the coronavirus temporarily deprived Plaintiffs of the ability to use their properties for their intended purpose. Because Plaintiffs have not plausibly alleged that the presence of the coronavirus caused “direct physical loss of or damage to” their insured premises or nearby property, Plaintiffs cannot state a claim for breach of contract under either their business interruption coverage or civil authority coverage. Insuring Defendants are therefore entitled to judgment on the pleadings on Plaintiffs’ breach of contract claim.

The court also granted judgment on the pleadings dismissing plaintiffs’ New York General Business Law § 349 cause of action, holding that that plaintiffs cannot “establish that they suffered injury as a result of’ the defendants’ conduct-as required to state a claim under N.Y. Gen. Bus. Law§ 349-because they did not plausibly allege “direct physical loss of or damage to” their insured property.

Plaintiffs, self-storage facilities, sued their commercial property insurer for business interruption coverage for losses allegedly stemming from their March 2020 forced closure during COVID-19. The policies’ business interruption coverages required “direct physical loss” of property, but did not contain a virus exclusion.

In GRANTING the insurer’s motion to dismiss plaintiffs’ complaint, the New York State Supreme Court, Erie County, held:

The Court agrees with Defendant that there are no facts, only conclusions, to support Plaintiffs’ claims. As such, the Court finds that Plaintiffs have failed to meet their burden and that dismissal is required. The complaint is void of any evidence to support the bald conclusion that the coronavirus caused an actual covered loss (physical or otherwise) under the subject policies. * * * Here, the subject policy language is specific, clear, and unambiguous. The insurance company covers losses “directly resulting from interruption of your business operations because of a business property loss insured under this policy.” Mura Affirmation at ¶ 13. “Physical loss” and “business property” are not ambiguous terms. Those are the terms included in the Policy and the Court will not now, as noted above, “rewrite the contract or impose additional terms which the parties failed to insert.” Supra.

The court also dismissed the complaint’s New York General Business Law § 349 deceptive acts and practices cause of action, holding that “[t]he case before this Court likewise stems from a private dispute outside the ambit of §349 of the General Business Law.”

Plaintiff, a Manhattan restaurant, sued its commercial property insurer for business interruption coverage for losses allegedly stemming from its March 2020 forced closure during COVID-19. The policy’s business interruption coverages required “direct physical loss of or damage to property” and did contain a virus exclusion.

In GRANTING the insurer’s motion to dismiss with prejudice; the court held:

The Complaint does not allege that the Café suffered a ‘direct physical loss’ of property that would provide for business interruption coverage under the Policy….The Complaint does not plausibly allege the Café suffered a loss covered under the Civil Authority Provision….The Court concludes that the Virus Exclusion is unambiguous and excludes the coverage sought by the Café.

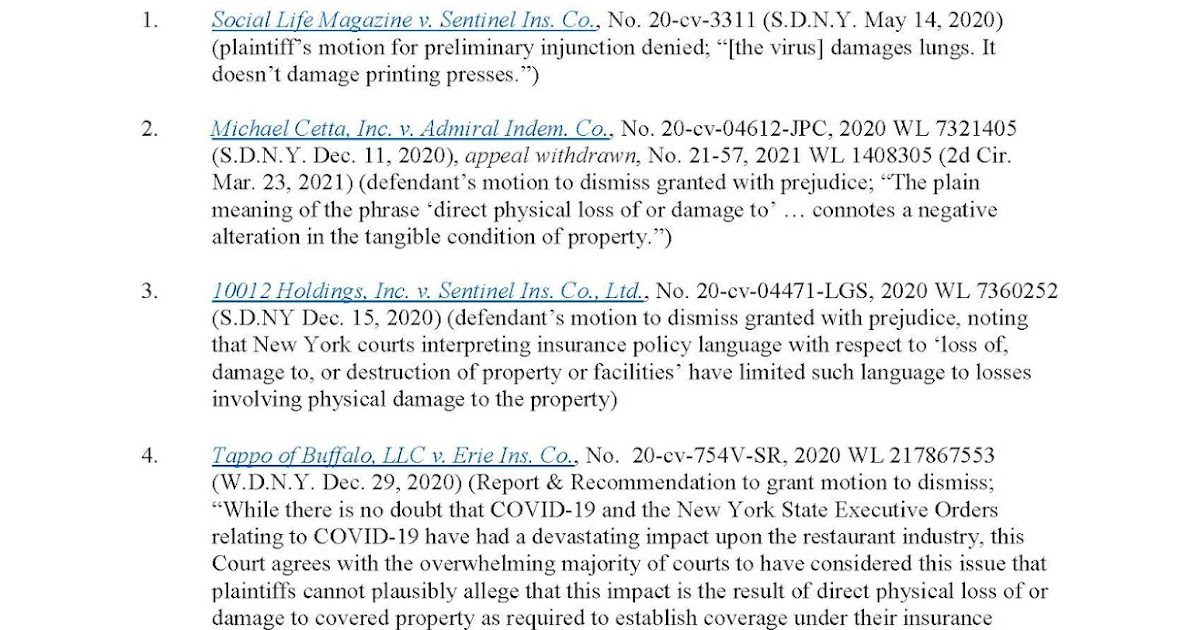

For an updated listing of all 23 New York COVID-19 #businessinterruption cases decided to date, click the image below.